Fuel Oil Report – No Party at the VISCO-theque

The HSFO complex has had a very mixed week, with weakness seen in VISCO but pronounced support seen in Asia.

Reports will not be published on Friday 18 April or Monday 21 April due to Bank Holidays in the UK.

The only exception is the Overnight & Singapore Window report, which will be published as usual on Monday 21 April.

The HSFO complex has had a very mixed week, with weakness seen in VISCO but pronounced support seen in Asia.

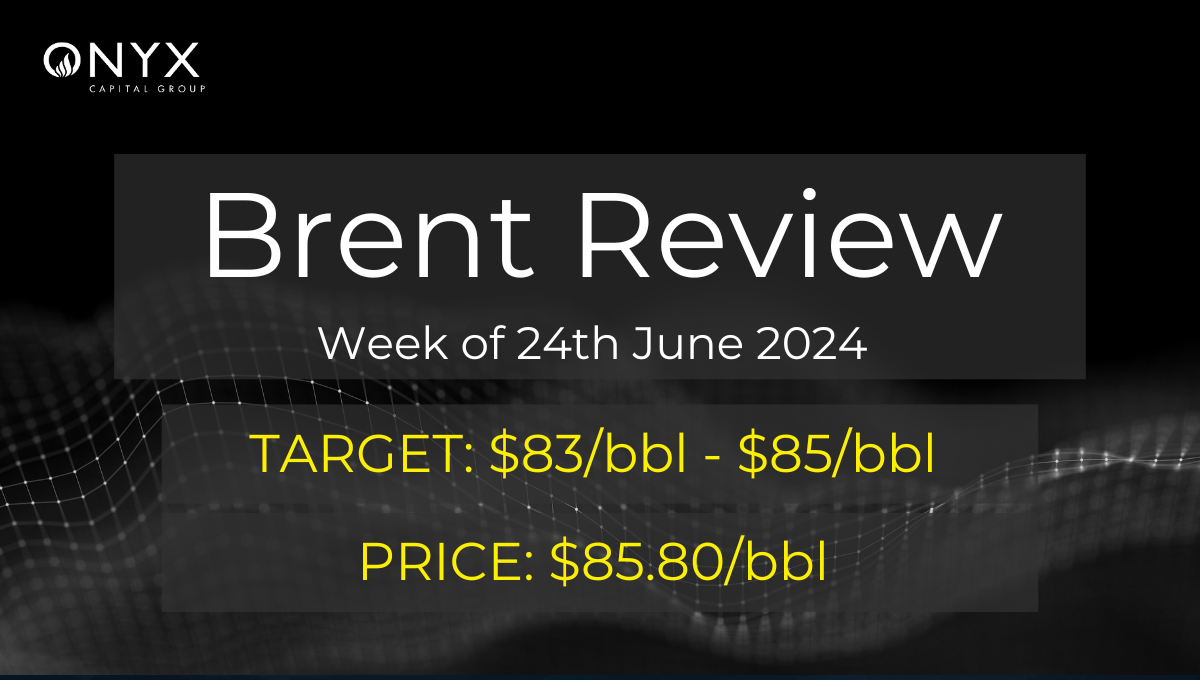

TARGET PRICE: $83/bbl – $85/bbl PRICE: $85.80/bbl Return of the pre-weekend bulls? On Monday, we forecast short-term bearishness to take the benchmark Brent crude futures to $83-85/bbl by the end of this week. We now see the September futures contract

The September Brent futures contract has been on an upward trend all morning, rallying to $86.10/bbl before meeting resistance here. The soon-to-be-prompt futures are now trading at $85.75/bbl as of 11:25 BST (time of writing)…

Short July 0.5 Sing crack Recently, the crack showed significant strength, trading up to $11.45/bbl due to concerns about potential supply issues following a fire at the Dangote refinery. However, Bloomberg reported that the incident was minor and the refinery

In this white paper, Onyx’s team explores the effectiveness of the CFTC COT Report in analysisng market positioning in the oil derivatives complex. Analysis suggests that for an up to date, expansive interpretation of current trader positioning for the whole

The September Brent futures contract initially rallied into the afternoon, climbing from $84.70/bbl at 12:20 BST to $85.30/bbl at 16:30 BST. Following this, however, the benchmark crude futures began to sell off and fell to $84.70/bbl at 17:20 BST (time

A Presidential Welcome – With Donald Trump currently marginally ahead at the polls and the first presidential debate against incumbent Joe Biden scheduled for tonight, it’s currently anyone’s guess as to whether he can play it Cool(idge) and convince the

The September Brent Futures contract has seen a mixed morning, trading from $84.30/bbl at 08:00 BST up to a high of $85.26/bbl at 10:25 BST before retracing down slightly to print at $84.86/bbl at the time of writing (11:15 BST).

Short July 92/MOPJ 92 has been struggling to keep up with the recent strength in RBOB and there is still a firm bullish trend in naphtha. We think this will continue into the end of the month so we expect

In addition to our regular Monday CFTC COT analysis report, Onyx Insight will publish its own in-house CFTC COT forecast ahead of the official Friday report. The model forecasts changes in long and short positions using machine learning, utilising Onyx’s

The September Brent futures contract has seen a downward trend all afternoon, softening from nearly $85/bbl at 11:35 BST to below $84/bbl at 14:40 BST.

The September Brent futures flat price has been well-supported this morning following an earlier decline.

On 17 June, the world went to sleep with the physical differential still in sub-zero territory at -30c/bbl and woke to a whole new regime with the physical diff bid above 1c/bbl.

The September Brent Futures flat price has had a fairly flat afternoon, trading between $85.30/bbl and $86/bbl.

The July ’24 EBOB crack hit a low of $14.10/bbl on June 12, establishing a floor through June 17 amid low liquidity. Heavy refiner selling peaked on June 24 with over 280kb of July’24sold. On June 18, RBBR found support