Brent crude futures endured a volatile week as prices grind lower and are on track for a third consecutive weekly decline. On 05 February, the Apr’25 contract closed below $75/bbl for the first time since 31 December. Market participants have taken profit from the recent rally and are wary of the implications of U.S. tariff threats on oil consumption. The key factors influencing crude prices this week are as follows:

- CTA Selling

- Tariffs

- Maximum Pressure’ on Iran

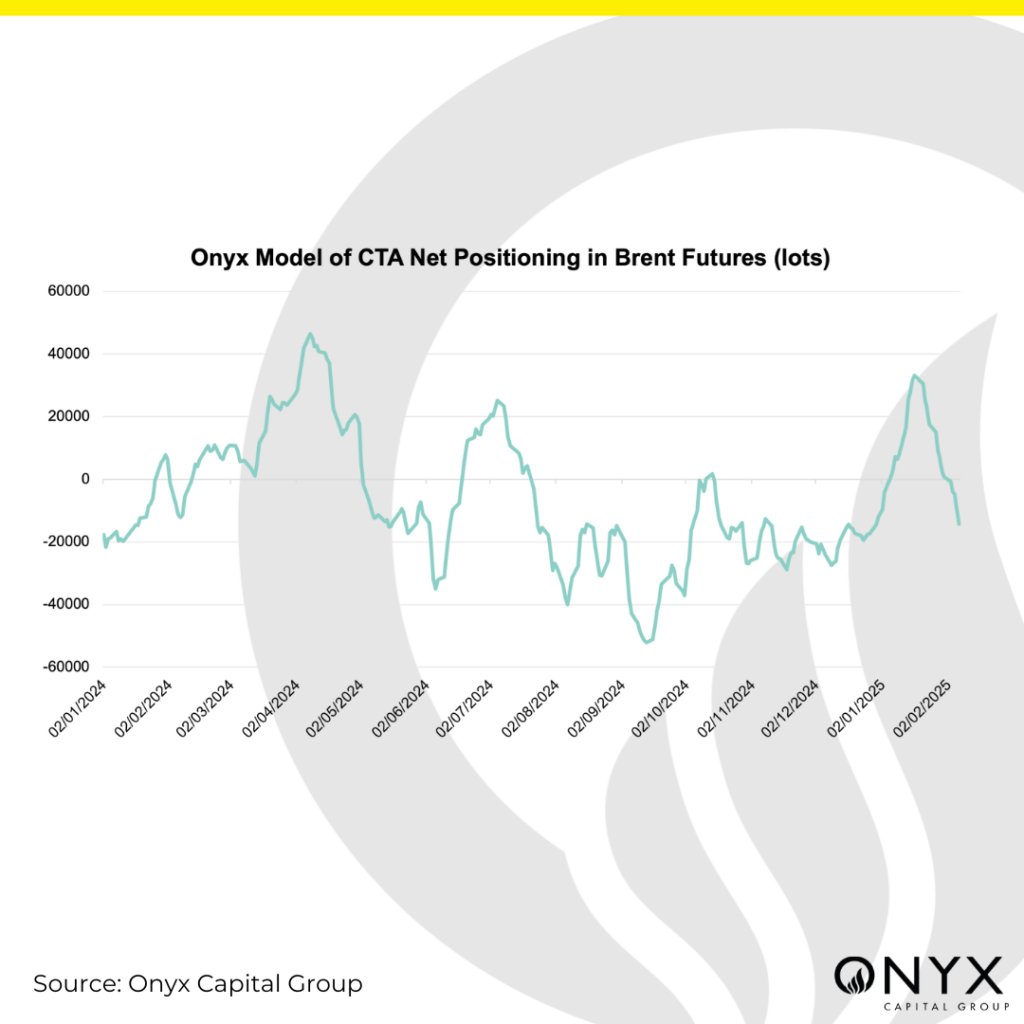

The crude sell-off was fuelled by CTAs getting shorter, as indicated by Onyx’s proprietary model. Net positioning in Brent futures fell below flat, from a peak of 33k lots on 17 January to -14k lots by 07 February, the lowest level since 30 December. The unidirectional bearish flow by CTAs likely exacerbated the flat price downtrend this week. In addition, prices were vulnerable to a bearish reversal because of the overcrowding of bullish positioning by money managers in Brent futures. The latest ICE COT data in the week ending 28 January showed that net positioning was at the highest level since April 2024. Given the recent sell-off, our CFTC predictor forecasts money managers to trim their positions in Brent futures for the week ending 05 February.

President Trump’s threats of tariffs on Canada, Mexico, and China were a key focus of the oil market this week. The (non-)imposition of tariffs on Canada and Mexico heavily influenced market sentiment as traders grappled with their potential reshuffling of oil flows, impact on heavy-light crude differentials, and spillover effects on refined products – including gasoline and fuel oil. In particular, the transatlantic arb (US gasoline vs European gasoline; RBOB vs EBOB) rose on fears that the cost of tariffs would be passed onto US importers as fewer crude imports from Canada and Mexico would cause lower gasoline output by domestic refiners. Despite the one-month delay to tariffs on Canada and Mexico, the Trump administration’s uncertain and unpredictable approach to future tariffs remains. The bearish reaction in crude prices reveals the market’s fears that the tariffs could spark renewed inflation and negatively impact economic growth and oil consumption. Moreover, the heightened uncertainty and volatility posed by tariff threats likely prompted long-positioned players to de-risk from their positions.

However, the downside of crude oil was offset by fears of greater supply risk as Trump reimposed ‘maximum pressure’ on Iran. Trump signed a directive implementing a campaign to reduce Iran’s oil exports to zero.

Under the Biden administration, Iran’s crude exports rose to around 1.5mb/d, where most are received by China’s independent refineries (teapots). The first batch of sanctions was announced by the US Treasury on 06 February, targeting entities and individuals in China, India, and the UAE, as well as several vessels. The threats initially triggered a spike in price action on 04 February as Apr’25 Brent jumped from $74.20/bbl to $76.60/bbl over an hour. Nonetheless, the rally was sold into amid profit-taking flows and prevailing bearish sentiment as earlier gains were nearly reversed on 05 February when Brent fell by $2.