Risk off, worry on

On Monday, we forecast March Brent futures to end the week between $75-79.00/bbl. At 1600 GMT, March Brent is within this range at $76.75/bbl as it expires today, and April becomes the prompt at $75.75/bbl. This week, Brent gingerly declined, although the downside conviction was tentative as a risk-off attitude prevailed. This can be seen in the short daily candlestick bodies during the week and low but stable volatility in the contract, shown by the narrow but stable Bollinger bands, pointing to consolidation just under $77.00/bbl in March.

Retrospectively, we identify three drivers of price action this week:

- Tariff uncertainty

- Turbulence in equities

- CTA net positioning falling

Clarity on tariffs that President Trump has threatened China, Mexico, and Canada continues to evade the market. Trump has failed to confirm whether oil and gas will be included in the proposed tariffs on either country north or south of the border. Still, their respective currencies have softened against the dollar, with the USD index rising to over 108 this morning, reaching a one-week high, driven by rising US Treasury yields. The US 10-year Treasury yield rose above 4.54%, rebounding as PCE held steady at 2.8% in December. President Donald Trump reminded BRICS member countries of a 100% tariff threat he made in November if these nations try to replace the USD. While these threats continue to be thrown around the world, the potential significant upside risk has failed to be bought into by the market this week, which could point to disbelief in the tariffs on Canada and Mexico’s 4.7mb/d crude exports to the US.

In the US, stock market worries have accelerated this week following last weekend’s shock. Chip manufacturer stocks lost hundreds of billions of dollars in value after news of the DeepSeek chatbot’s performance surprised and amazed the market. Further uncertainty may have stemmed from the FOMC releasing a fairly hawkish statement on Wednesday: “Economic activity has continued to expand at a solid pace. The unemployment rate has stabilized at a low level in recent months, and labour market conditions remain solid”. The Fed kept rates between 4.25-4.50% as they waited for better clarity on growth and inflation, showing the recent sideways data has failed to inspire support.

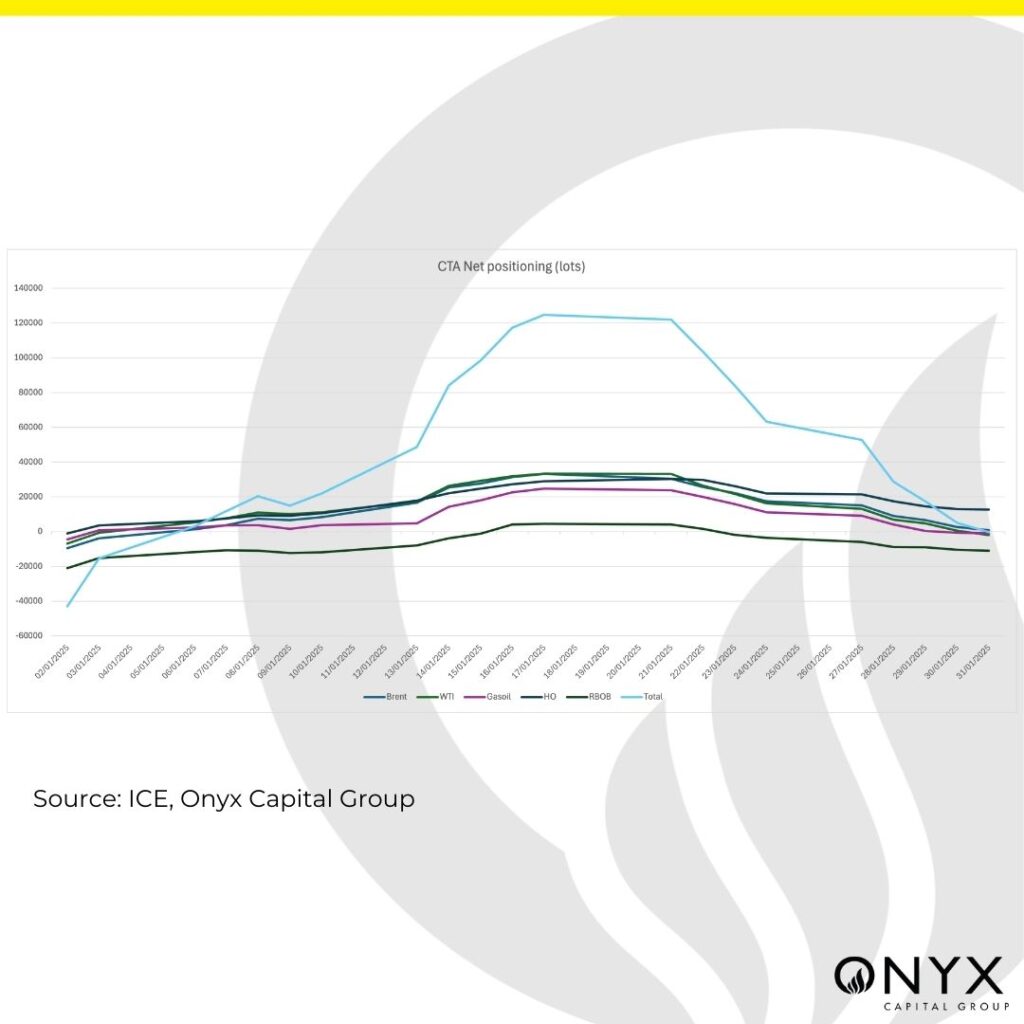

Looking to Onyx’s CTA net positioning model, the overall net positioning dropped into negative territory this week. Total estimated positioning fell from over 52k lots on 27 Jan to an estimated -258 lots on 31 Jan. This points to the weight of length added from CTAs over January being removed as the net positioning dropped to where it began the month. It seems likely that there will be further unwinding of positions from here.