Brent rally? Aaaaaand it’s gone.

Brent crude futures is on track to see a small gain w/w, as the Apr’25 contract rose from $74.50/bbl on 17 Feb to $77/bbl by 20 Feb before correcting lower to $75/bbl by 16:00 GMT on 21 Feb (time of writing). Looking at the daily candlesticks in Brent, four consecutive higher closes were followed by a resounding bearish Marubozu candle and bearish engulfing pattern, wiping out gains made earlier in the week. $77/bbl was a key resistance level as prices failed to surpass the highs of 11 Feb. We caveat that the three factors listed were ultimately wrong-footed by news of the US pressuring Iraq to reinstate Kurdish oil exports, amounting to 300kb/d, or face sanctions alongside Iran.

The key factors driving crude prices this week include:

- Ukraine’s attack on the CPC pipeline

- OPEC+ potentially delaying their return of barrels

- Bullish CTA flows

On Monday, Ukraine attacked an oil pumping station for the Caspian Pipeline Consortium (CPC), possibly reducing flows by around 30% to 40%, according to Russian sources. The 1.5mb/d Caspian pipeline to the Black Sea accounts for approximately 80% of Kazakhstan’s oil exports and carries oil from its three largest fields, including the Tengiz project led by Chevron. Following the attack, Kazakhstan seeks to discuss this matter with Ukraine, as confirmed by Foreign Affairs Ministry spokesman Aibek Smadiyarov. Ukrainian attacks on Russian oil infrastructure have been a regular occurrence, but this is the first attack on energy infrastructure linked to Western companies. In line with this, crude prices were also supported by easing expectations of a peace deal between Russia and Ukraine, with the uncertain timeline and Ukraine maintaining a hardline stance.

Another factor supporting oil prices was the market’s expectation that OPEC would delay its planned output hike in April. On Monday, an OPEC delegate revealed to Bloomberg that the group is considering delaying their 120kb/d output hike in April, although no decision has been made yet. Should OPEC+ proceed, this would mark the fourth delay in planned output hikes since commencing production cuts in 2022. Oil traders have echoed this sentiment, as a Bloomberg survey showed that over 70% of the 30 traders and analysts surveyed anticipate that OPEC+ will postpone their plans to increase output in April by one to three months. OPEC faces both demand-side and supply-side uncertainty as sanctions, tariffs, and tepid demand contribute to the uncertain near-term outlook. As a result, we think any decision is more likely to be based on the price level of oil at the time of the next OPEC+ meeting.

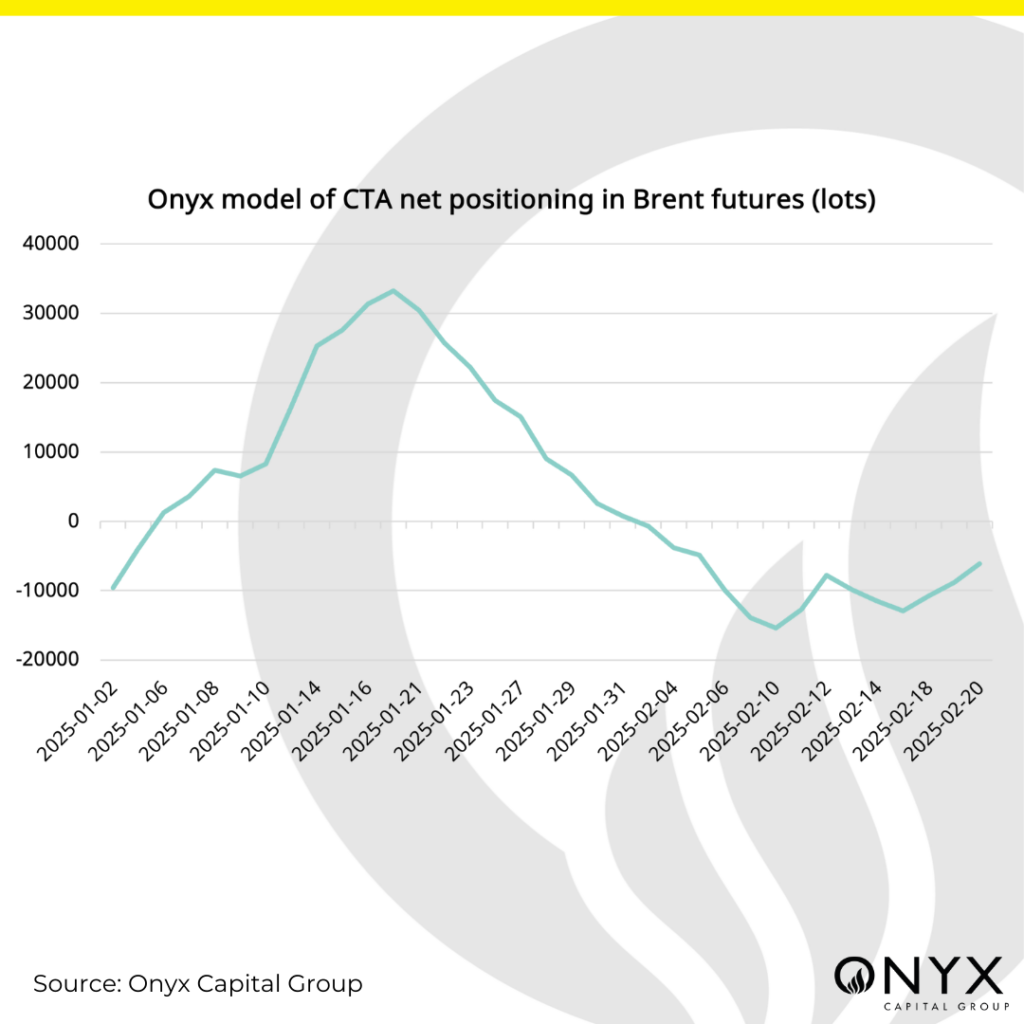

Finally, bullish CTA flows briefly reinvigorated crude prices as net positioning increased in Brent futures. Net positioning rose for three consecutive days from 17 Feb to 20 Feb, from -12.9k lots to -6k lots, a 2-week high. In contrast, Onyx’s CFTC predictor forecasts that money managers will get shorter in Brent futures in the week ending 18 Feb. This indicates hesitancy from risk-takers in building long positions amid uncertain and rangebound price action.