The Jun’25 Brent futures contract saw yet another weekly gain in the final week of March, opening at around $71.30/bbl on 24 Mar and now trading at $73.00/bbl at 1300 BST on 31 Mar. The M2 Jun’25 contract (soon to become M1) is now testing the $73.30/bbl resistance level last seen on 27 Feb. It remains to be seen whether price will have sufficient bullish momentum to firmly break above low $73/bbl levels. Overall, we expect moderate strength in Brent but see potential for some bearish retracement with the start of Trump’s tariffs on 2 Apr, ending the week in a range between $72-75/bbl.

We anticipate the following to be core drivers of price action this week:

- Rising tensions between US and Iran

- April 2 ‘Liberation Day’

- Brent technicals and market positioning

After the US issued sanctions on Chinese teapot refineries involved in Iranian oil on 21 Mar, Donald Trump is now ramping up his campaign of ‘maximum pressure’ this week. The US president said that if Iran does not make a nuclear deal with the US, there will be secondary tariffs and “bombing the likes of which they have never seen before,” in a telephone interview on Sunday. Despite the gravity of Trump’s threats, Iran remains unwilling to engage in direct negotiation with the US, instead preferring to respond via proxy with Oman. Not only does Iran reject talks with the US, but Iran’s Supreme Leader Ayatollah Khamenei also stated today that Trump will “surely receive a strong reciprocal blow” if the US “commits any mischief”. Any broadscale escalation of regional conflict in the Middle East likely would spur on strong bullish sentiment in crude oil prices, having already seen US attacks on Yemen and the breakdown of the Gaza ceasefire over the past fortnight. While Trump has yet to impose fully fledged sanctions on Iran, this latest flare-up marks a step toward direct measures to restrict Tehran, deepening concerns over potential supply disruption.

On the other hand, Trump’s ‘Liberation Day’ scheduled for April 2 will be a key bearish factor in crude oil markets this week, with reciprocal tariffs expected to include all nations that charge fees on US exports, promising to match the countries’ duties. After already imposing tariffs on aluminium, steel, and now 25% levies on automobiles, this latest set of tariffs could inevitably stir concerns surrounding global economic growth and, in turn, oil demand. Despite some encouraging macroeconomic data out of China this week with manufacturing PMI hitting a yearly high in March at 50.5, Trump’s Liberation Day has renewed the threat of a potential global trade war. China has warned Washington that it will issue retaliatory tariffs if the US president follows through, delivering a hit to the world’s two largest consumers of crude oil. It remains to be seen whether traders will become more risk-off in crude oil this week in light of the tariffs, or if the market prices this in ahead of the announcement on Wednesday. Trump has indicated he is open to granting exemptions for certain countries in exchange for concessions, adding uncertainty over which trading partners the duties will ultimately target. In any case, April 2 ‘Liberation Day’ represents an escalation in the global trade war and has already resulted in bearish sentiment in equity markets, with the FTSE 100, S&P 500, and Nikkei 225 all down today.

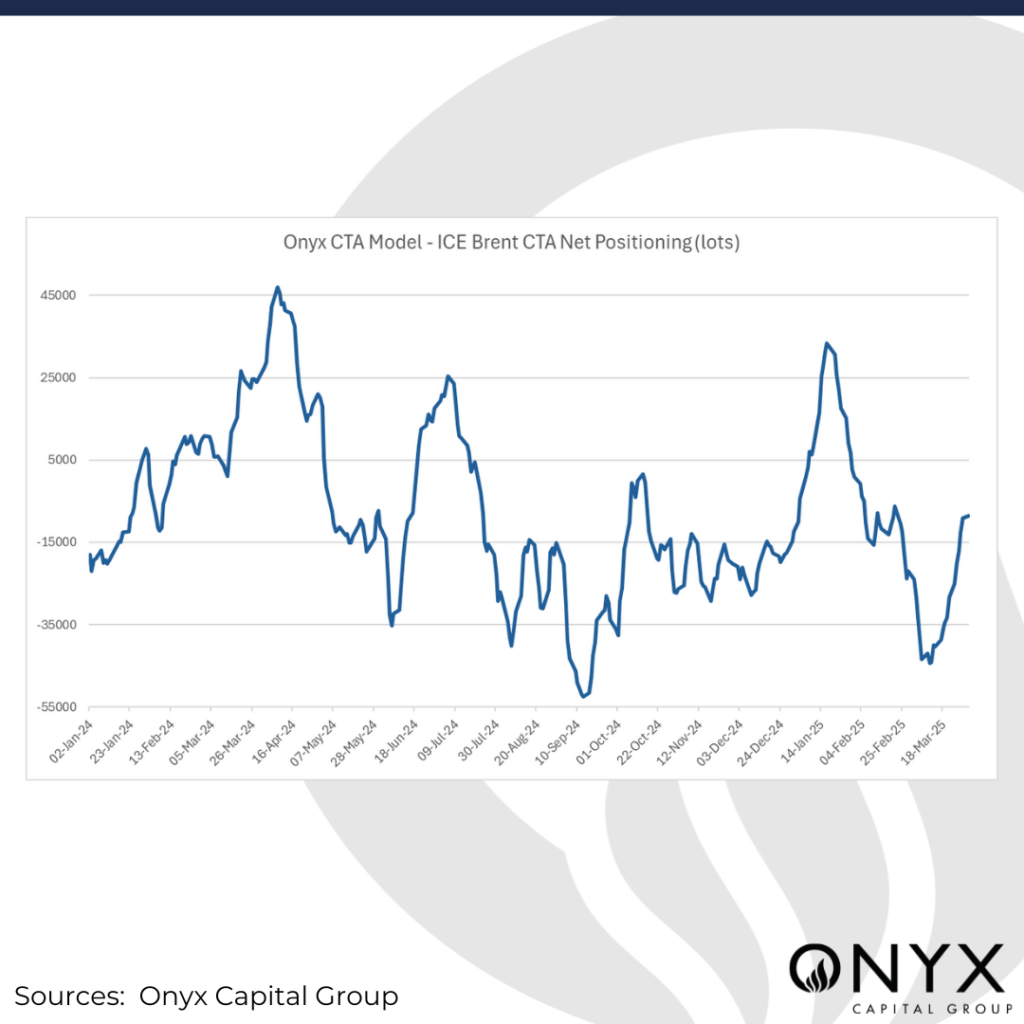

Meanwhile, technical indicators show that Jun’25 Brent futures could have room to move upwards from the current $73.00/bbl level. The MACD line crossed above the signal line on 19 Mar and currently remains above it, showing sustained bullish momentum. This, in combination with the 14-day RSI being recorded at 55 on 31 Mar, suggests that the contract has the potential to see further strength. Looking at moving averages, price used the 40-day MA as a support level at $72.50/bbl on 28 Mar, after seeing a bearish Marubozu candle on this day. However, the Jun’25 contract is fast approaching the 200-day MA and upper Bollinger band around the $74.00/bbl psychological level, which could act as a potential resistance. ICE COT data shows that money managers were risk on in Brent futures for the week to 25 Mar, adding 50mb (+17.5% w/w) to their longs while removing 5.5mb (-6% w/w) from their shorts. Onyx CTA positioning has now reached the most bullish level for March, increasing from a monthly low of-44kb on 12 Mar up to -8.5kb as of 31 Mar. As a result, we maintain a moderately bullish view for this week in Jun’25 Brent futures.