After the Apr’25 Brent futures contract briefly touched above the $77/bbl mark on 20 Feb, the prompt contract has seen lacklustre start to the week, swiftly falling to $74.40/bbl by 1300 GMT on 24 Feb (time of writing). Apr’25 Brent futures has remained largely rangebound between $74/bbl and $77/bbl handles over the past fortnight, seeing a pullback every time price attempts to break free from this range. With this week being IE week, traders and oil companies are congregating in London. We would not expect much movement unless we see a US-driven geopolitical shift to send them back to their trading screens. We anticipate Brent to remain in the current range but also see potential for bearish sentiment to pick up.

We expect the following to be the core drivers of price action this week:

Technical Indicators showing bearish momentum increasing

Developments in Russia-Ukraine negotiations

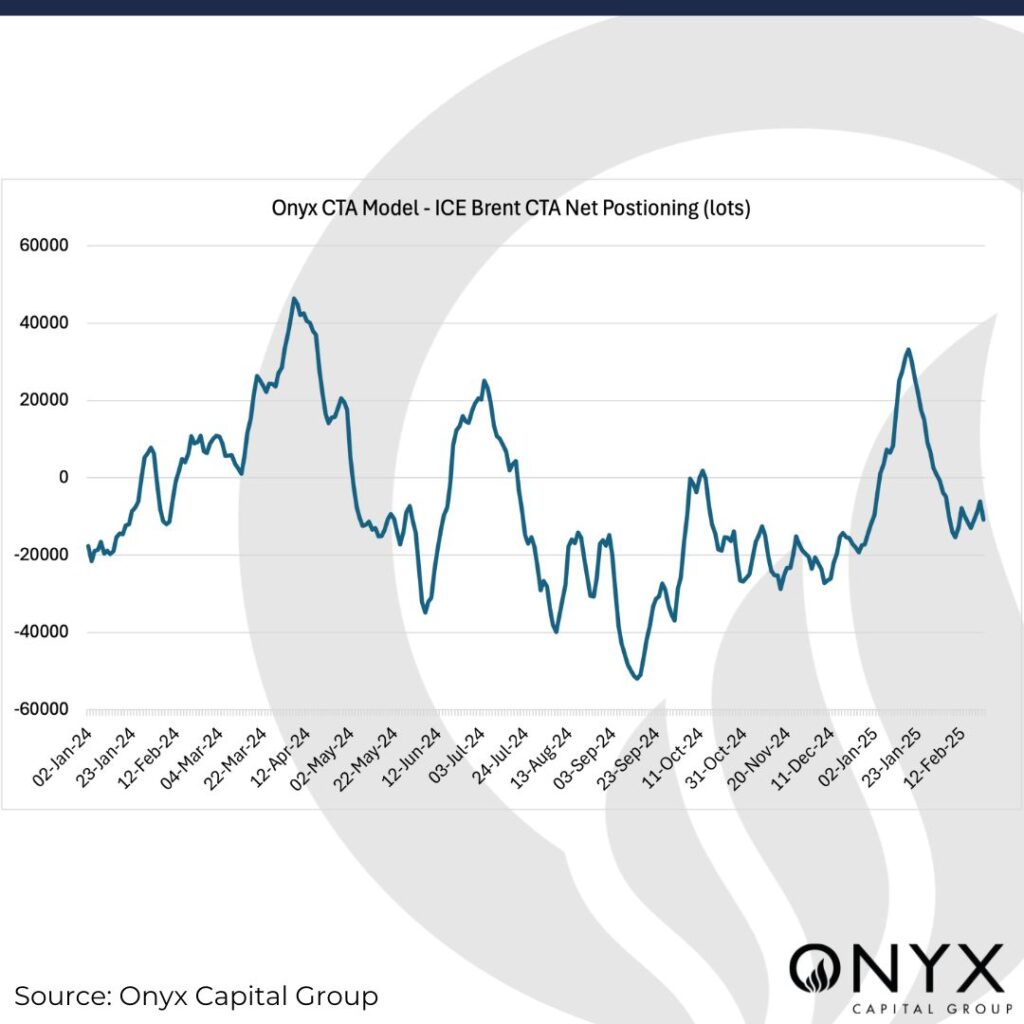

Bearish ICE positioning changes

Last week, Brent crude prices were largely supported following the Ukrainian drone attack on a pump station belonging to the Caspian Pipeline Consortium, which cut oil flows along the major route from Kazakhstan by 30-40% on last Tuesday (18 Feb). The CPC has since labelled the incident as an act of terrorism, raising concerns of similar attacks to come. However, offsetting this, Iraq is looking to resume flows of northern Kirkuk crude to the Turkish port of Ceyhan as early as Wednesday (26 Feb), with Iraq’s Deputy Oil Minister claiming the pipeline could ship about 185kb/d of crude. Russia-Ukraine ceasefire negotiations are further easing fears of supply disruption, with President Trump now announcing a new phase of talks to take place in the Saudi capital Riyadh on 25 February. US Secretary of State Marco Rubio has said that American and Russian delegations have broadly agreed to pursue three goals; restoring staffing at their respective embassies in Washington and Moscow, to create high-level teams to support Ukraine peace talks, and to explore economic cooperation. This presents some hope of progress toward ending the war, however, no concrete action has been taken to resolving the conflict on the ground yet. Until any significant developments toward a ceasefire are made, crude oil markets could remain in a waiting game with traders looking for a clearer picture of the geopolitical risks to supply in Europe.

In terms of financial flows, ICE COT data for the week ending 18 Feb showed a 14.4mb (-3.9%) w/w deduction in money manager long positions in Brent. This marked the third consecutive week that money managers have reduced length in ICE Brent, showing that funds are now in a period of de-risking. In addition, net positioning currently sits at its lowest level in six weeks, at just over 261mb, while the money managers long:short ratio has fallen from 4.47:1.00 to 3.85:1.00 w/w. Not only is it clear that optimism in Brent futures is fading with speculative players hesitant to add length, but the week to 18 Feb saw money managers add a substantial 9.6mb (+11.7%) to their Brent short positions, following a removal of shorts for the two previous weeks.

Momentum technical indicators show that price action in Brent futures remains on a downtrend overall, with the MACD line staying firmly under the signal line throughout most of February. On 20 Feb, we briefly saw the MACD line cross above the signal line, however, immediately dipped below on 21 Feb where it remains on 24 Feb. Furthermore, RSI was recorded at 43 on 24 Feb, suggesting that there is potential room for price to continue downwards even at the lower end of the $74-77/bbl range. The candlestick patterns also suggest there is insufficient bullish momentum to break out to the upside. For instance, we saw a bearish Marubozu candle on the daily chart on 20 Feb when price touched $77/bbl, showing aggressive selling pressure came in at these high levels. Therefore, our view for the next week in Brent is skewed to the downside, while we caveat that any breakdown in Russia-Ukraine negotiations or the imposition of US tariffs could lead to a sudden return of bullish sentiment in Brent futures.