Bye Bye Biden

The M1 Brent futures contract surged to its highest level since July last week but has since softened to $80.80/bbl at 12:45 GMT (time of writing). We expect the M1 contract to end the week between $78 and $81/bbl, in line with the current 13-day and 5-day moving averages, respectively, where we see key support and resistance levels.

At the time of writing, the prompt contract is on track for a third consecutive day of bearishness. Should we see another red candle by the end of the day, the M1 contract will display a “three black crows” pattern, a bearish indicator for the contract. Still, it is vital to consider a possible rise in volatility from President Trump’s inauguration today. Hence, we identify three pivotal drivers of this week’s price action:

- Declining exports and imports of oil from China.

- Trump’s presidential inauguration instilling supply-side uncertainty

- CTA positioning displaying waning buy-side interest

According to Bloomberg, Donald Trump is reportedly set to invoke an array of emergency procedures to boost domestic energy output shortly after his inauguration. Mr. Trump may also immediately start reversing Biden-era climate regulations, such as Mr. Biden’s recent decision to restrict offshore drilling in 625 million acres of US waters. Such measures to boost US oil production by the incoming President may be subjected to federal courts but may still have an initial bearish push on oil prices. On the other hand, Trump’s geopolitical plans continue to inject uncertainty into the market. We may see an easing of sanctions on Russian oil should the new administration negotiate a settlement to the conflict between Russia and Ukraine, pressuring oil prices lower. However, tough sanctions on Iran and tariffs on Canadian and Mexican oil may inflate oil prices. Amid this uncertainty, we recommend keeping an eye on possible hedging unwinds after the inauguration as Mr. Trump’s actions become clearer to market participants.

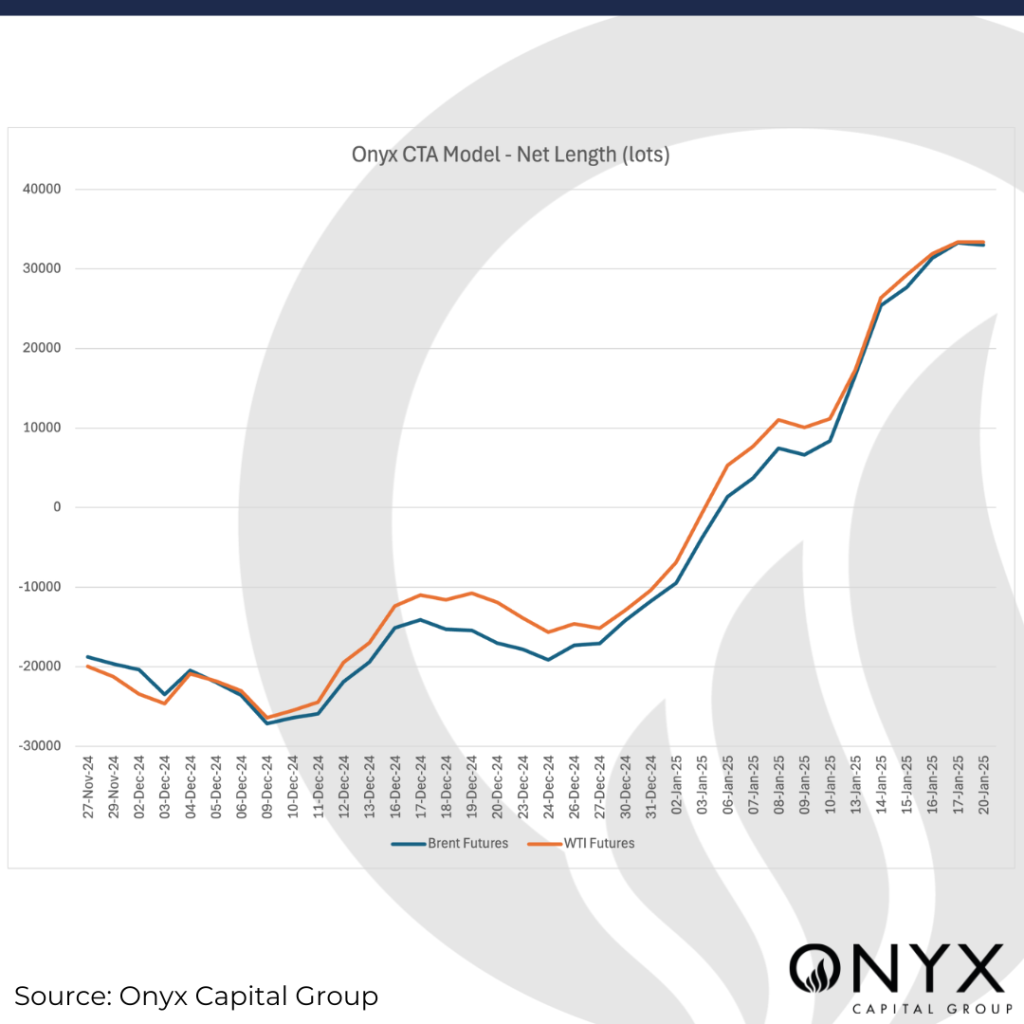

In the paper market, Onyx’s CTA model demonstrates a 296% rise in net length in the ICE Brent futures to 33.2k lots in the week ending 17 Jan. However, this buy-side interest appears to be waning d/d (see attached chart). In addition, on 20 Jan, we saw a 1% decline in net length d/d to 33k lots at the time of writing.

Finally, China, the world’s largest crude importer, continues to showcase a tepid appetite for crude. According to the Customs General Administration, the country’s crude oil imports fell 1.1% year over year in December (Nov: +14.4% y/y), while oil product imports declined by 30.8% y/y (Nov: +1.7% y/y). China’s oil refinery throughput fell in 2024 for the first time in two decades (except for 2022 due to the pandemic’s effects). An estimate based on domestic output and crude imports shows that while China’s crude oil surplus may have seen a m/m decline, it saw a more significant y/y increase at 1.15mb/d in 2024 (2023: 760kb/d).