The Apr’25 Brent crude flat price has stabilised after last week’s sell-off and is trading at $74.60/bbl as of 12:00 GMT on 17 February (time of writing). While Trump’s tariff threats have raised concerns about their implications for oil demand, the restart of the Russia-Ukraine peace talks has cast a shadow on the oil markets. This week, we are cautiously bearish and anticipate Brent to finish the week between $73 and $75/bbl as the market evaluates the following factors:

- Russia-Ukraine Peace Talks

- Market Positioning

- OPEC+ Uncertainty

The Ukraine peace talks loom large this week as critical US-Russia talks begin on Tuesday in Saudi Arabia, following Trump’s phone call with Putin last week. US Secretary of State Marco Rubio is set to meet Russian Foreign Minister Sergey Lavrov, where the meeting aims to lay the groundwork for a Trump-Putin summit. Although we are still in the early stages of a deal, the prospect of peace negotiations under Trump represents a significant shift from his predecessor’s approach. However, there are concerns that Ukraine has been excluded from US-Russia talks while European leaders gather in Paris on Monday to discuss Ukraine and European security. We do not expect a solution to emerge overnight, and there are plenty of items to agree before the war can end, and more importantly for a durable peace to succeed. However, the mere initiation of negotiations from a market sentiment point of view increases the downside risk for oil prices. A lifting of US sanctions on Russia will not prove consequential for oil. However, it is the lifting of EU sanctions that will ultimately make a difference – potentially causing a reversal in the reshuffling of Russian crude oil flows to Asia, and a return of its diesel to the old continent.

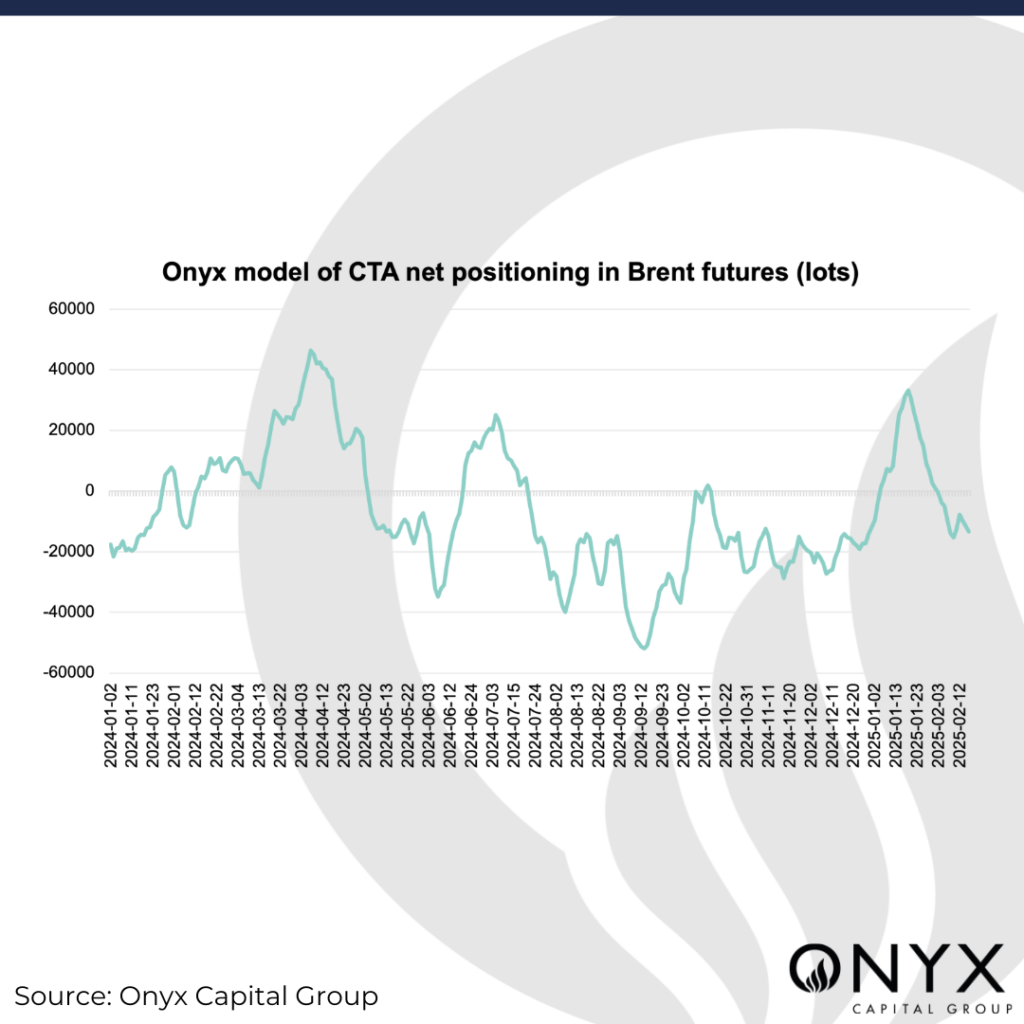

Despite the recent sell-off, the money manager positions in Brent futures remain relatively overcrowded to the buy side. The latest ICE COT data for the week ending 11 February indicated that the long:short ratio rose to 4.5:1.0, the highest level in the YTD. At current levels, the market is vulnerable to a downside reversal in the event of a bearish catalyst. Meanwhile, Onyx’s CTA model shows continued selling interest in crude, indicated at -13k lots as of 17 February. Brent and WTI’s net positioning is the lowest of the five oil futures benchmarks. In 2024, the average CTA net positioning in Brent was -8k lots, leaving room for CTAs to increase their exposure. This capacity to deploy additional risk could amplify volatility in the event of a price breakout.

Finally, OPEC+ remains in the fray as they test the market with headlines. On 17 February, the headline of “OPEC+ [considering] a delay of April oil supply restart” triggered a 40c rally in one minute at 10:15 GMT, which was very quickly sold into. This implies that the producer group acknowledges the downside risk and that reducing voluntary barrels in April is not a given. The North Sea crude physical market is relatively weak due to European spring refinery maintenance. This is reflected by the negative Apr/May/Jun’25 Brent futures fly, in line with the period OPEC+ is expected to return barrels. While the OPEC Secretariat, in its latest monthly oil market report, makes a fundamental case that would support higher production from April onwards, the reality is that any decision is more likely to based on the price level of oil at the time of the next OPEC+ meeting.