Uncertainty is the Only Certainty

The front-month Brent futures contract fell from an open of nearly $73/bbl last Monday to an intraday low of $68.30/bbl on Wednesday. While prices found support there, they oscillated between $68 and $72/bbl for the remainder of the week and today currently stand at $70.75/bbl at the time of writing. The Trump whirlwind is generating a lot of uncertainty, and the market is becoming increasingly skittish in terms of its exposure as the predictability of future conditions becomes more arduous to ascertain. We expect that the M1 Brent contract will end the week between $68 and $72/bbl as drivers potentially work against each other. We recommend monitoring the following three drivers of price action this week:

US macro data with implications on Fed policy

Geopolitical developments around Ukraine

Risk takers paring their exposure to ICE Brent

The timeline of a potential peace deal between Russia and Ukraine is unclear. Still, the US appears to be pushing an agenda to force Ukraine down a peace path as it halts military aid and intelligence sharing. At the same time, the US has raised the threat of sanctions on Russia while concomitantly looking at how to revoke existing sanctions should a peace deal be secured. This week, US officials are to meet a Ukrainian delegation in Riyadh, which could pave the way to the signing of a rare earth mineral deal which was scuppered when President Zelenskyy last visited the White House. In the Middle East, the US has upped the hawkish rhetoric through its Treasury Secretary Scott Bessent, who last week stated the US was prepared to “shut down Iran’s oil sector and drone manufacturing capabilities”. The US has also rescinded a waiver that allowed Iraq to purchase Iranian electricity. If peace talks around Ukraine prove constructive, risk premia should deflate. On the other hand, if the US follows through with maximum pressure on Iran, the price outlook becomes brighter, considering that no producer will spare capacity of any consequence has stepped up to indicate they would fill the gap.

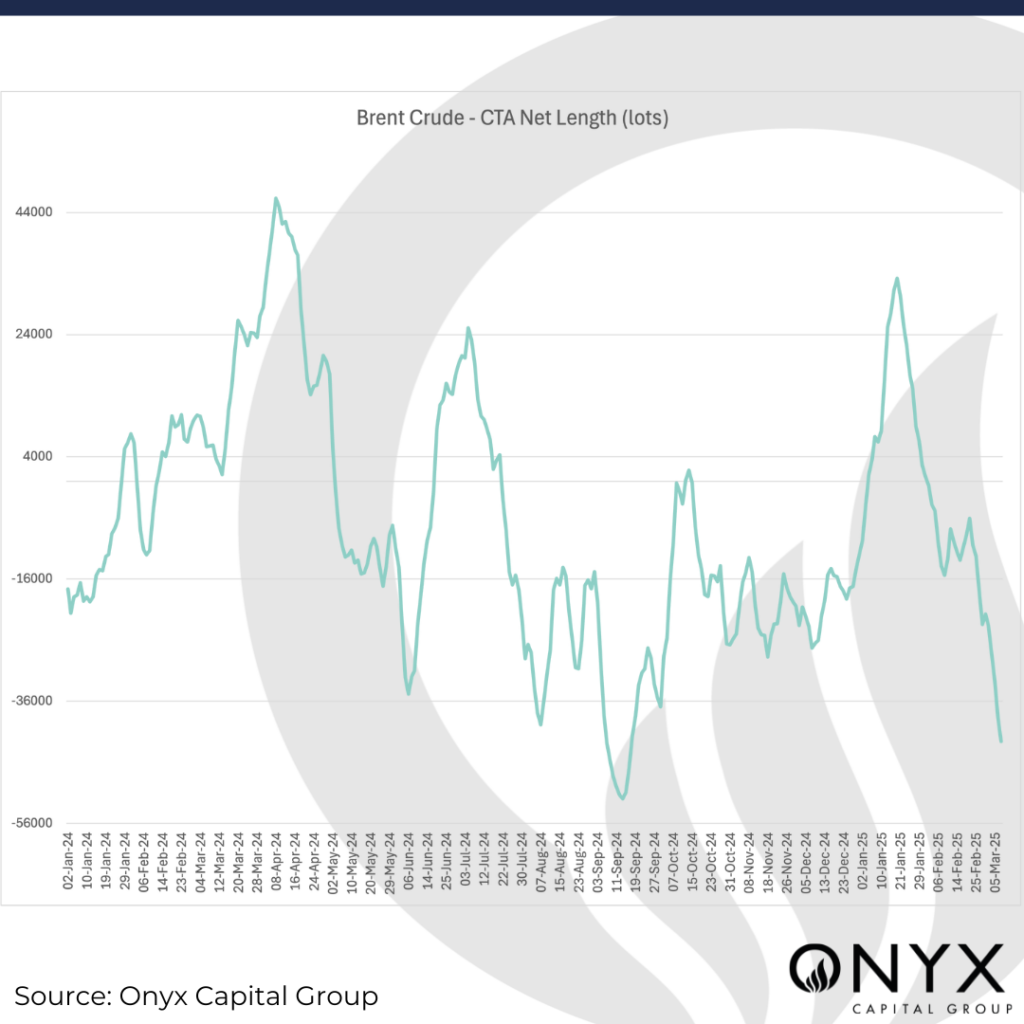

Looking at commitment of traders data, the ICE exchange reports for the week ending 4 March a 2.55% reduction of open interest w/w in ICE Brent futures. De-risking was evident in the money managers category of participants as these cut over 60mb from their net length, taking their long-to-short ratio to its lowest since November 2024. Onyx’s timelier CTA model also displays net positioning in ICE Brent declining from -21k lots on 28 Feb to -38k lots on 6 Mar. The paring of net length in the past successive weeks appears symptomatic of a market unwilling to assume a more neutral stance amidst the unpredictability of current conditions. However, should price-sensitive buyers like China come back into the fray and begin to push prices higher again, money managers could take the opportunity to ride their coattails.

Finally, it is a big week for US macroeconomic data amidst concerns of negative impact following the imposition of tariffs on key trading partners. Following a soft US job report last week, which pegged the unemployment rate at 4.1%, inflation will be in the spotlight this week, which will likely affect how the Fed chooses to conduct its rate policy at its FOMC meeting on 18 March. US CPI data for February will be released Wednesday, with the consensus view looking for a +2.9% y/y increment. If inflation remains sticky, the Fed can afford to stay on hold, considering that labour markets are not yet showing the kind of weakness that would prompt the central bank to perform a balancing act to fulfil its dual mandate.