Tariff-ying Times Ahead

The front-month Brent futures contract jumped from $74.60/bbl at 20:00 GMT last Friday to $75.60/bbl at 12:15 GMT this morning (time of writing). Oil prices face an increasingly uncertain time ahead of the rising possibility of a trade war amid US President Donald Trump’s planned tariffs. While further downside remains possible, technical indicators highlight possible support here, so we expect the contract to sit between $74 and $77/bbl at the end of this week.

We expect the following three factors to be critical drivers of price action this week:

- A possible trade war impacting manufacturing and oil demand

- Net positioning declining in Brent

- Technical indication pointing towards short-term support

Donald Trump’s tariffs and the rising possibility of a trade war have been hanging over risk assets like the sword of Damocles. China’s retaliatory tariffs on roughly 80 US products come into effect today. Additional measures by China, including an investigation into Google for anti-trust violations and controls over the sale of critical minerals like tungsten (which the US is an important supplier of) may cause Washington to harden its stance on China. President Trump has also said he will introduce an additional 25% tariff on steel and aluminium imports into the US. Although this decision could most significantly hit Canada and Mexico, steel and aluminium stocks across Japan, South Korea, India and Australia sharply declined on this news. While this development is expected to be less disruptive for the US than the shift away from Russian titanium, analysts expect it could still affect critical manufacturing supply chains at a time when the outlook for US manufacturing is still uncertain – possibly impacting oil demand. Finally, this uncertainty has also supported the US dollar, which may adversely impact dollar-denominated risk assets such as oil.

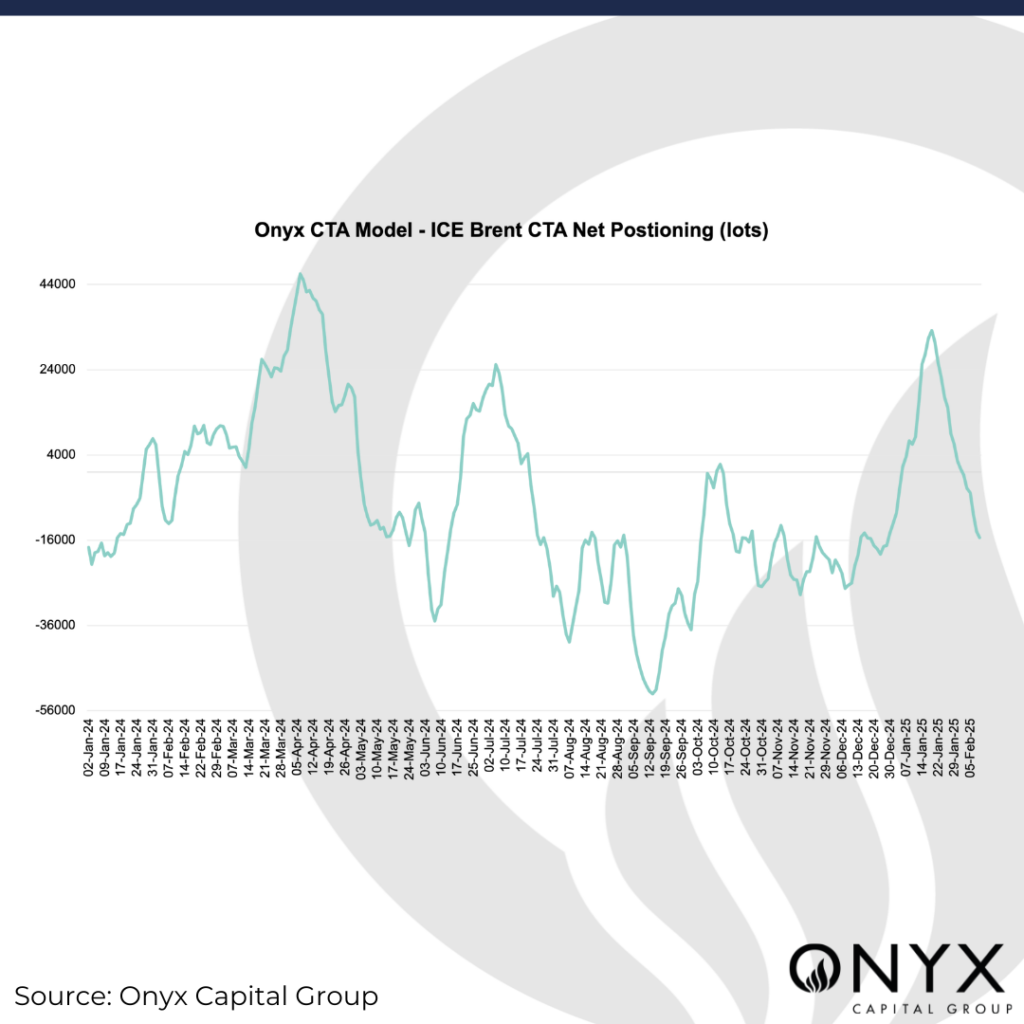

Financially, we see net length declining in the ICE Brent futures complex. CFTC COT data for the week ending 4 Feb showed net managed-by-money positioning decline from just over 300kb last week to around 285kb, taking the long:short ratio to 4.28:1.00 (down 1% w/w) – just above the 50th percentile for all weeks since 2013. Looking at more timely data, Onyx’s CTA model shows that CTA net length in Brent futures fell to -13.9k lots on 7 Feb from +773 lots on 31 Jan. Considering the lows of -27k lots from as early as December 2024, we see further room for bearish momentum in the futures.

Nonetheless, technical indicators point towards potential retracement upward in the short term. The structural 100-day moving average (MA) of $75/bbl has been an interesting support level for the M1 futures contract. However, it remains critical to see whether the contract will break past the 10-day MA of $75.90/bbl (a recent resistance level). Momentum indicators such as the 10,6,6 stochastic oscillator show the %K line moving just above the slower %D line for the first time since 17 Jan. While the MACD histogram remains below 0, we see the MACD line’s discount to the signal line narrowing over the past couple of days. Coupling this with an uptick in the RSI, which is in the neutral territory, we see further room for a retracement upwards in the near term. Still, we refrain from a very bullish forecast due to the uncertainty in the market alongside the CTA selling this week.