16 January 2025: 16:30 GMT

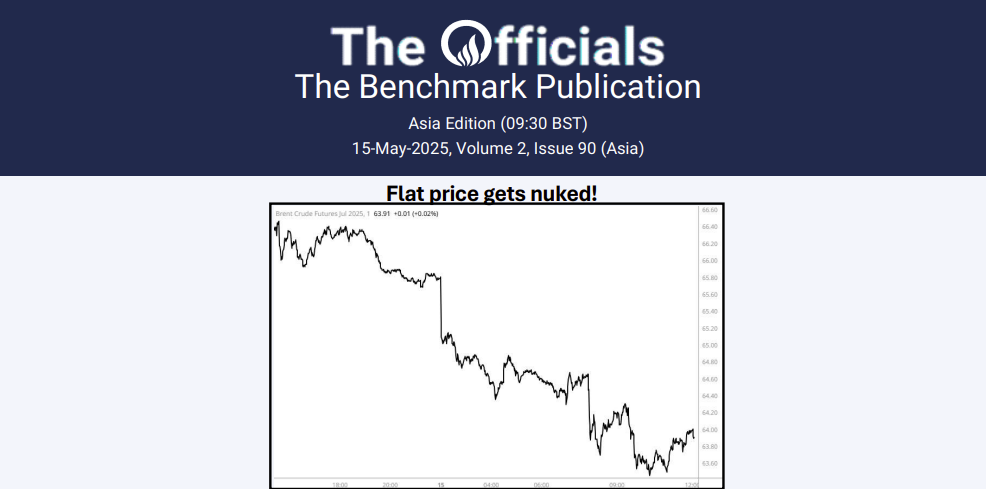

The foreboding fears of Trump’s assault on free trade and the transport of oil around the globe, supplemented by Biden’s last minute sanction splurge, have added a hefty premium to the cost of crude. Just look at the flat price chart! We’ve seen it across grades. Having pumped up Brent flat price by $8 in the past month, and with global oil demand of around 103 mil b/d, that adds upwards of $800 million per day to the world’s oil bill! The poor consumer and struggling economies will obviously have to foot the bill, as they always do . This straight up money leakage from the importing nations to the producers is almost a global ‘war tax’ placed by the US on the rest of the world and a transfer of money from consumers to producers. Saudi sources have expressed their gratitude to the US as their budgets are now and finally looking good – higher prices mean higher revenues, thanks Biden! The US’ actions have played directly into producers’ hands by pummelling the consumers.

In ‘The Officials’, Onyx Capital Advisory publishes outright values, spreads, cracks and boxes for the main energy commodities traded in the marketplace. The published values are determined independently and on a fair market basis by our team of dedicated professionals.

We invite you to read our reports, which will initially be published twice a day, reflecting closing values at 16:30 Singapore time (SGT) and at 16:30 London time (GMT/BST).

For any comments, please reach out to us through the emails provided in the signed documents.