12 February 2025: 08:30 GMT

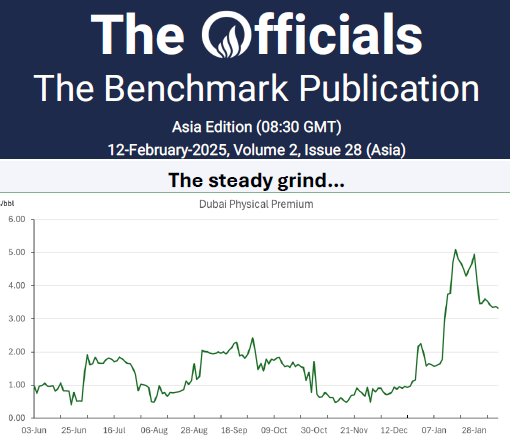

Our sources in China report that one cargo ready to discharge to the account of PetroChina was affected by the prompt enactment of the 10% tariff on crude imports from the US. Including the freight cost, PetroChina would face a tariff bill around $8.00/Bbl. This would force PetroChina to redirect the cargo elsewhere. But separately our sources in Beijing say, not too many cargoes are scheduled to ship in from the US. So, regarding tariffs, one source says, “ready steady, go”. The Dubai window has really settled into a pattern for February: lots of bidders outnumbering the sellers, but nobody stepping up to set the pace, all afraid to pick up the Totsa mantle. On the sellside, only Chevron and Reliance actually got involved today, while the buyside was awash with bidders – the usual suspects, Vitol, Equinor, PetroChina being some of the most active – raising bids, but they seemed largely to concur that sellers were asking for too much.

In ‘The Officials’, Onyx Capital Advisory publishes outright values, spreads, cracks and boxes for the main energy commodities traded in the marketplace. The published values are determined independently and on a fair market basis by our team of dedicated professionals.

We invite you to read our reports, which will initially be published twice a day, reflecting closing values at 16:30 Singapore time (SGT) and at 16:30 London time (GMT/BST).

For any comments, please reach out to us through the emails provided in the signed documents.