10 February 2025: 08:30 GMT

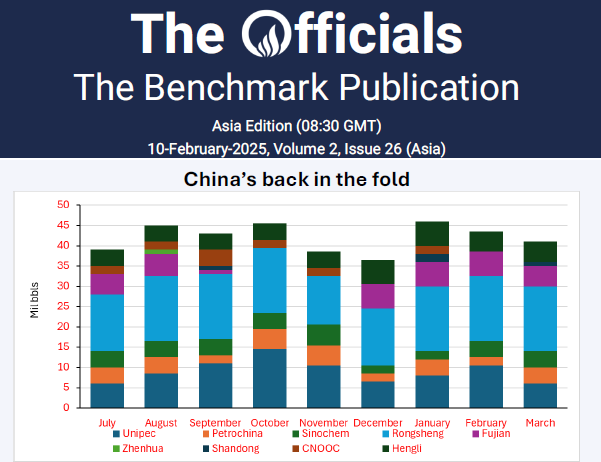

Later today, The Officials will publish a liquidity report on exchange traded volumes, so keep an eye on Onyx Hub, X and LinkedIn to discover our newest report and findings! In the meantime, Unipec’s Saudi allocation fell to 6 mil bbls, from 10.5 mil bbls in the February allocation. But Petrochina seesawed from 2 million bbls in February to 4 mil bbls in March. Overall, the allocations fell 2.5 mil bbls to 41 mil bbls, their lowest since December. Of course, Rongsheng is still the biggest recipient, after all they are a joint venture partner, with a steady 16 mil bbls for the past 3 months. It’s all go among Middle Eastern producers – don’t forget ADNOC OSPs released on Friday. Murban is priced at $80.22/bbl but the big surprise is that Upper Zakum is priced at Murban +$0.10! That’s to say $80.32/bbl, while Umm Lulu is Murban +$0.25 and Das is Murban -$0.40. And don’t forget fuel oil is looking good, providing support to some of the heavies. This is on a relative basis as Dubai is still inflated post Totsa’s squeeze.

In ‘The Officials’, Onyx Capital Advisory publishes outright values, spreads, cracks and boxes for the main energy commodities traded in the marketplace. The published values are determined independently and on a fair market basis by our team of dedicated professionals.

We invite you to read our reports, which will initially be published twice a day, reflecting closing values at 16:30 Singapore time (SGT) and at 16:30 London time (GMT/BST).

For any comments, please reach out to us through the emails provided in the signed documents.