07 February 2025: 08:30 GMT

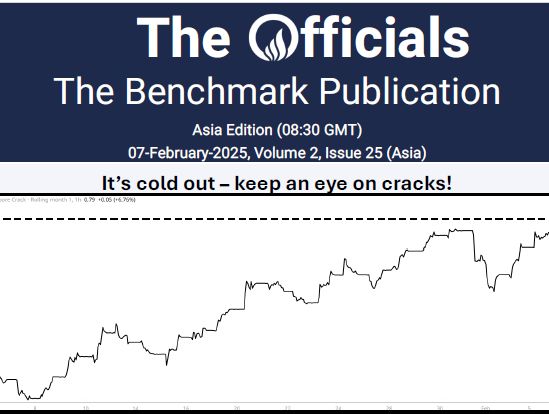

Trump is creating the volatility in the crude oil price and then the market does its thing in the products side. And boy, there is a lot going on. As Dubai rose it pulled up the price of fuel oil; many traders see the bunker fuel as a Dubai linked product and HSFO is performing big time. The prompt Sing380 high sulphur fuel oil crack closed positive for the first time since 2019 and climbed as high as $0.79/bbl this morning! Traders also noted lots of March to Q3 spread buying and also pointed to higher seasonal demand due to structural factors such as greater refinery complexity.

In ‘The Officials’, Onyx Capital Advisory publishes outright values, spreads, cracks and boxes for the main energy commodities traded in the marketplace. The published values are determined independently and on a fair market basis by our team of dedicated professionals.

We invite you to read our reports, which will initially be published twice a day, reflecting closing values at 16:30 Singapore time (SGT) and at 16:30 London time (GMT/BST).

For any comments, please reach out to us through the emails provided in the signed documents.