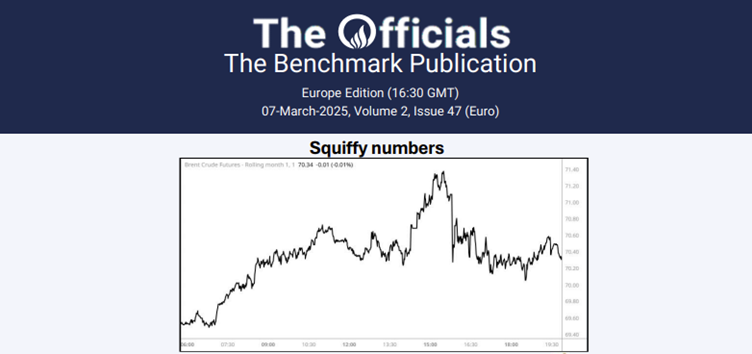

The Apr’25 Brent futures contract was initially supported up to around $73.30/bbl circa 07:00 GMT on Wednesday, where it saw more selling and weakened to $72.95/bbl at 10:20 GMT (time of writing). The soon-to-be prompt May’25 Brent futures contract similarly softened from $72.75/bbl to $72.40/bbl in this time. The market continues to be trading on thin liquidity amid the International Energy Week conference in London. The US and Ukraine have reportedly agreed on the terms of a draft minerals deal, injecting hope that we may see an end to the war between Ukraine and Russia soon. The contents of the deal are still unclear, although Reuters reported, via a source, that the deal does not specify any US security guarantees or continued flow of weapons. A future weapons shipment deal is still being discussed between Washington and Kiev. The market will now await EIA stats on weekly changes in US crude oil and product inventories for the week ending 21 Feb. API estimates for US crude oil showed a 0.640mb decline in stocks w/w. If the EIA confirms a decline in inventories at 15:00 GMT on Wednesday, it would mark the first weekly decline in US crude oil inventories since the week ending 23 Jan. In macroeconomic news, Taiwan has revised its 2025 GDP growth forecast from 3.29% to 3.14% due to budget cuts alongside the rising threat of US tariffs. The GDP growth rate for 2024 stood at 4.59%, by comparison. Finally, at the time of writing, the Apr/May’25 and Apr/Oct’25 Brent futures spreads stand at $0.49/bbl and $2.40/bbl, respectively.