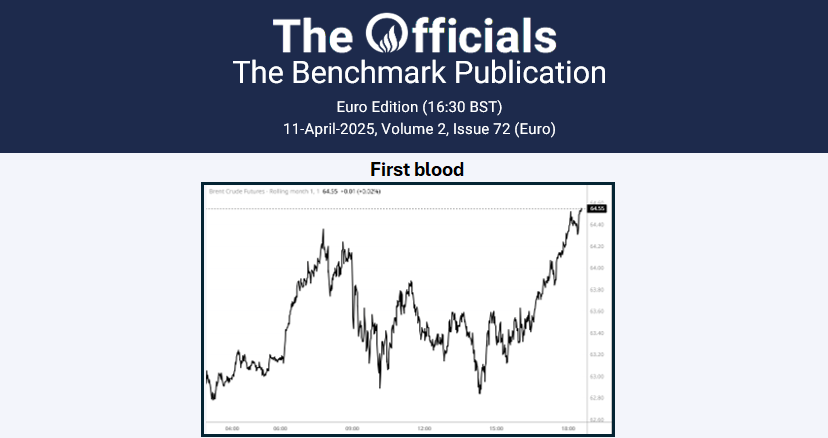

The May’25 Brent futures contract initially recovered from overnight lows of $70.60/bbl this morning, trading up to $71.10/bbl at 0730 GMT. However, prices have now reversed these gains, declining to $70.25bbl at 1050 GMT (time of writing). Bearish sentiment in crude oil has persisted on news of the April OPEC+ output increase and ongoing concerns surrounding US tariffs. In the news today, Russia has said Ukrainian President Zelenskiy’s statement to Trump on readiness to negotiate is positive, as per Reuters. However, it is not yet clear to Moscow who it might be negotiating with, Kremlin spokesman Dmitry Peskov said on Wednesday. In other news, Indonesia plans to build a new 500kb/d oil refinery as part of the country’s push to ensure energy security. The refinery will be able to process domestic and imported crude oil, and will produce up to around 532kb/d of various oil products, according to Argus Media. A timeline has not been provided for the development of the refinery, with many of Indonesia’s existing downstream expansion plans having stalled. Indonesia has agreed to provide $40 billion worth of funding to 21 first-phase downstream projects. Finally, China wants its refiners to produce less fuel and more petrochemical products as the EV boom alters the country’s consumption of diesel and gasoline, Bloomberg reported. This came as the National Development and Reform Commission stated in its annual report that China “will advance petrochemical industries…by cutting the output of refined petroleum products”. At the time of writing, the May/June’25 and May/Nov’25 Brent futures spreads stand at $0.43/bbl and $1.98/bbl, respectively.