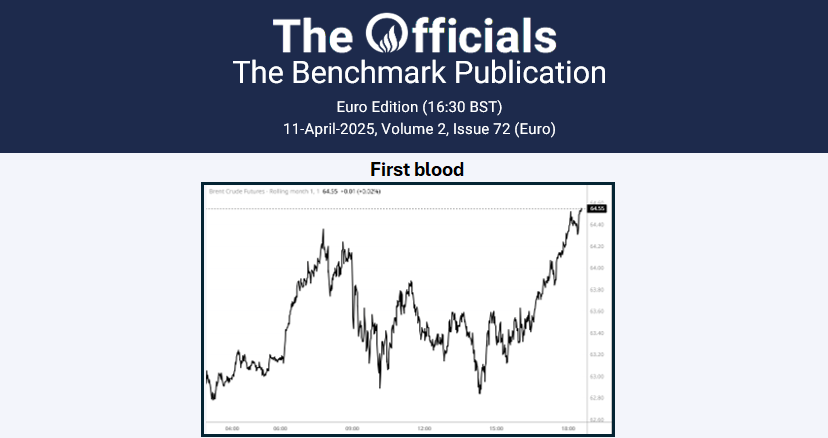

The May’25 Brent crude futures bounced above $70/bbl on Monday morning, reaching a high of $70.67/bbl at 09:51 GMT, and trading at $70.40/bbl by 10:45 GMT (time of writing). As the market contends with bearish factors, including tariff uncertainty and OPEC+ output increases, $70 is holding up as a critical level of support. The U.S. will push Ukraine for a ceasefire commitment at Saudi-led talks, following Trump’s suspension of military aid to pressure Kyiv into negotiations. Meanwhile, European allies are drafting security proposals, though uncertainties remain over Russia’s stance and the future of U.S. support. Kurdistan Region’s oil exports may resume later this month, as Baghdad, Erbil, and international oil companies near a final agreement, with key disputes largely resolved but ongoing talks needed to secure payment guarantees and contractual adherence before full implementation. At CERAWeek, oil executives face a downturn with weak prices, layoffs, and investor pressure, while Trump’s pro-drilling push clashes with industry caution on investment and output growth. China’s newest refiner, Shandong Yulong Petrochemical, plans to test-run its second 200kb/d crude unit in late March, boosting crude imports and refined product output, though adding pressure to already thin refining margins amid waning domestic fuel demand. Finally, the front (May/Jun) and 6-month (May/Nov) Brent futures spreads are at $0.48/bbl and $2.29/bbl respectively.