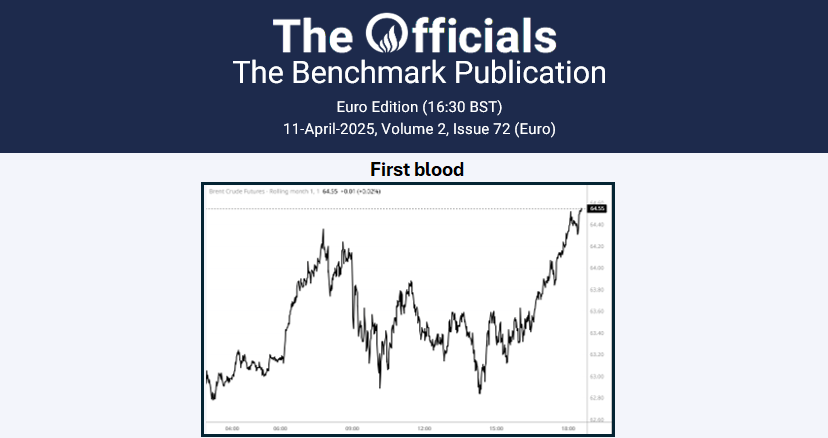

The Apr’25 Brent futures contract has seen a volatile morning, trading up from a low of $74.62 at 7:51 GMT to $75.06 at 9:56 GMT followed by a drop to $74.84 before rallying up to $75.24 at the time of writing (10:23 GMT). In headlines, Chevron is in talks with the Trump administration following pressure from top Republican officials, including Secretary of State Marco Rubio, to exit Venezuela. Critics argue Chevron’s operations there financially sustain President Nicolás Maduro’s regime, which has faced US sanctions for human rights violations. Chevron, the only major oil producer operating in Venezuela under a waiver, contributes about 20% of the country’s oil production, nearing Maduro’s target of 1 mb/d. Meanwhile, Chinese refiners are seeking alternative oil sources from the Middle East and Africa after Beijing imposed tariffs on US crude in response to Trump’s import tax hike on Chinese goods. Chinese state majors may need to replace around 200 kb of US crude daily, according to Energy Aspects. At the time of writing, the front (Apr/May) and 6-month (Apr/Oct) Brent Futures spreads are at $0.54/bbl and $2.96/bbl respectively.