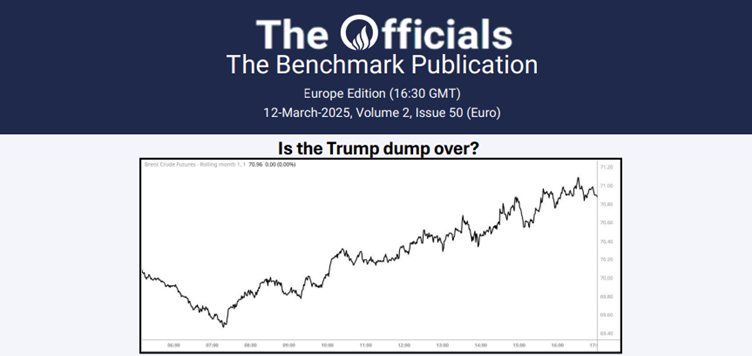

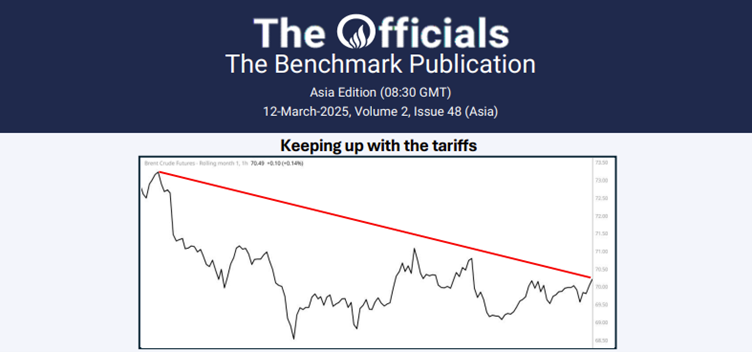

The Apr’25 Brent futures contract climbed to $76.40/bbl at 03:00 GMT but softened into the day, hitting $75.50/bbl at 10:15 GMT. The contract finally saw support at this level and rose to $75.70/bbl at 10:38 GMT (time of writing). The soon-to-expire Mar’25 Brent futures contract moved similarly and now stands at $76.75/bbl. Canada and Mexico continue to face the threat of a 25% tariff on exports to the US. However, President Trump has yet to make a decision on whether this excludes oil imports from Canada and Mexico, stating that this would depend on whether the countries “treat us properly” and if the oil is “properly priced”. In other news, Malaysian NOC Petronas is reportedly looking to boost the country’s oil and gas output over the next three years, aiming to sustain it at 2mb/d between 2025 and 2027 from 1.7mb/d in 2024. Japan is considering pledging support for a $44 billion gas pipeline in Alaska in an attempt to stall trade tensions with the US, as per a Reuters report. In other news, Syria is seeking to import oil through local intermediaries after its first post-Assad government import tenders failed to garner interest from major oil traders who may be steering clear of financial risks. Syria’s interim government has issued tenders to import 4.2mb of crude oil and 100,000 mt of fuel oil and diesel “as soon as possible”, as per Reuters. Finally, at the time of writing, the Apr/May’25 and Apr/Oct’25 Brent futures spreads stood at $0.75/bbl and 3.35/bbl, respectively.