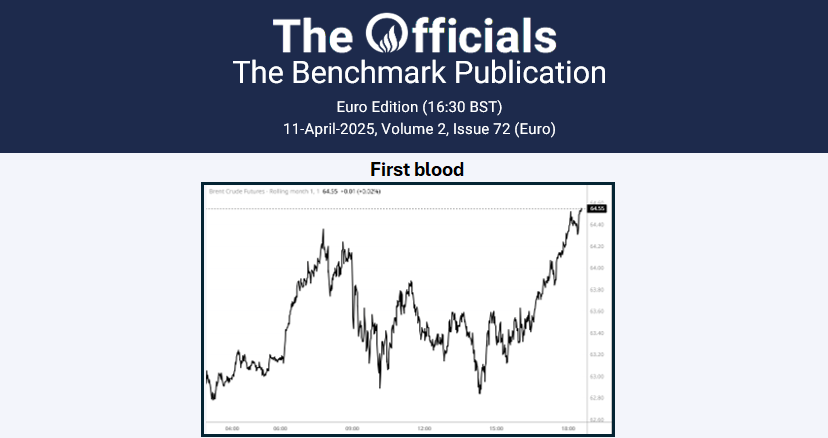

The Mar’25 Brent futures contract has seen gradual weakness this morning, declining from just under $81.90/bbl at 0520 GMT down to $81.65/bbl at 1055 GMT (time of writing). In the news today, Yemen-based Houthis have signalled a pause in their months-long attacks on commercial ships following the Gaza ceasefire deal, as per Bloomberg. Houthi leader Abdulmalik Al-Houthi stated that the group would follow the stages of implementing agreement, but also that they are ready to provide military support to Palestinians in the event of “any Israeli breach, massacre, or siege”. In other news, Indian Oil Corp has bought 7 mb of spot Middle Eastern and African crude to replace sanctioned Russian crude, including a rare 2mb purchase of Abu Dhabi’s Murban crude sold by Totsa, according to Reuters. Other purchases included Nigeria’s Agbami and Akpo crude and Gabon’s Rabi Light. Meanwhile, OPEC’s share in India’s crude oil imports in 2024 increased to nearly 51.5% from 49.6% in 2023, rising for the first time in nine years, as per Reuters. Finally, China’s GDP expanded by 5.4% y/y in Q4’24, surpassing market forecasts of a 5.0% rise and accelerating from 4.6% growth in Q3’24. At the time of writing, the Mar/Apr’25 and Mar/Sep’25 Brent futures spreads stand at $1.37/bbl and $5.69/bbl, respectively.