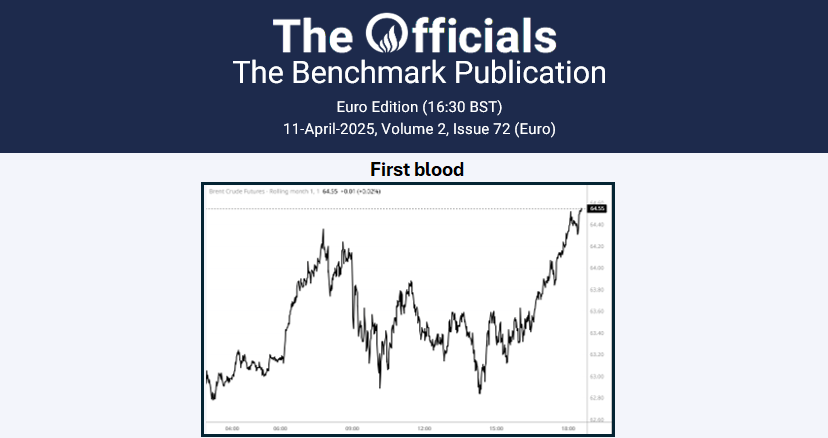

The May’25 Brent futures contract initially saw weakness this morning, trading from around $71.15/bbl at 0500 GMT down to $70.50/bbl at 0915 GMT, however, found support at $70.80/bbl by 1050 GMT (time of writing). Crude oil prices have seen bearish pressure since OPEC+ announced on 03 Feb it will increase oil output starting from April. In the news today, US President Trump confirmed plans to impose 25% tariffs on Canada and Mexico, with Trump also signing an order to double US tariffs on China to 20%, according to Bloomberg. In retaliation, Canada has announced counter-tariffs targeting around $20 billion in US goods, while China is imposing up to 15% tariffs on a range of agricultural goods and blacklisting more than 20 US companies. In other news, the White House has now suspended all military aid to the Ukrainian government after President Zelenskyy failed to sign a minerals deal with the US on 28 Feb. An unnamed White House official told Reuters, “President Trump has been clear that he is focused on peace. We need our partners to be committed to that goal as well”. Meanwhile, Russian authorities have put out fires at an oil pipeline in the southern region of Rostov caused by a Ukrainian drone attack, as per Reuters. The region’s acting governor, Yuri Slyusar, did not identify the damaged pipeline but said on Telegram that the overnight drone attacks led to no other reports of damage apart from the fires. Finally, China’s CNOOC is expected to launch an upgraded refinery complex around June, including more than a dozen newly installed facilities for $2.74 billion. The upgrade could expand crude processing capacity at CNOOC’s Daxie plant in Ningbo by 50% up to 240kb/d, according to Reuters. At the time of writing, the May/June’25 and May/Nov’25 Brent futures spreads stand at $0.41/bbl and $2.03/bbl, respectively.