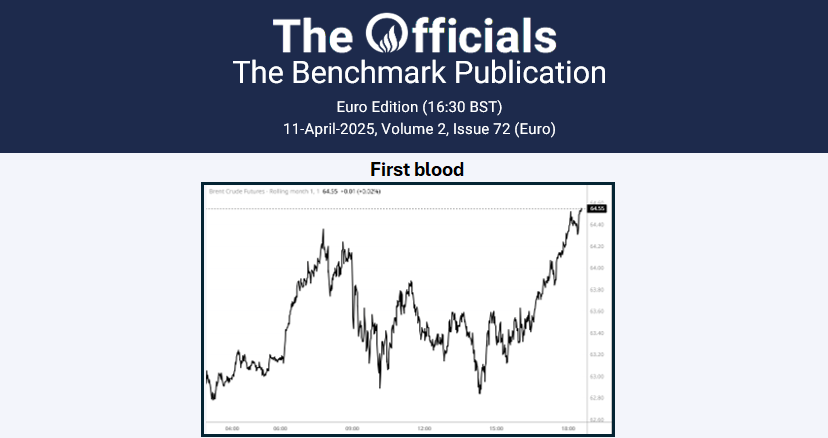

The Apr’25 Brent futures contract softened overnight, from $75.55/bbl at 0400 GMT to $75.05/bbl at 10:33 GMT (time of writing). China has retaliated against Trump’s tariffs with a 15% levy on US liquefied natural gas and coal, a 10% tariff on crude oil, and export limits on key minerals like tungsten and molybdenum. Additional tariffs will also apply to US farm equipment and certain cars. OPEC’s oil production fell by 70 kb/d in January to just over 27 mb/d, primarily due to a fire at Iraq’s Rumaila oil field, which temporarily cut output by 300 kb/d. Despite this, Iraq’s total production averaged over 4mb/d, aligning with its OPEC quota. Pakistan has signed a $1.2 billion oil import deferral agreement with the Saudi Fund for Development to ease its fiscal burden and ensure a stable petroleum supply. Saudi Arabia’s non-oil business sector grew at its fastest pace in over a decade in January, driven by strong new orders and business activity. The Riyad Bank PMI rose to 60.5 from 58.4 in December, its highest level since September 2014. At the time of writing, the Apr/May’25 and Apr/Oct’25 Brent futures spreads stood at $0.63/bbl and $3.09/bbl, respectively.