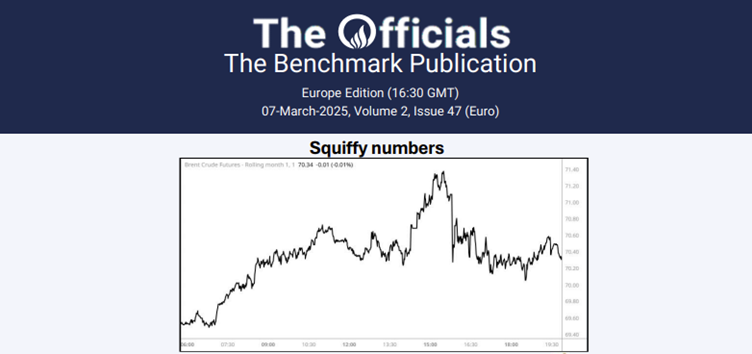

Apr’25 Brent futures has seen weakness overnight, falling from $73.85/bbl around 02:30 GMT down to $73.10/bbl at 10:40 GMT (time of writing). Crude oil prices have seen bearish sentiment after Trump said that 25% tariffs on imports from Canada and Mexico will come into effect on 4 March, in addition to raising tariffs on China by 10%. In the news today, Alberta, Canada’s top oil-producing province, is projecting its first budget deficit after four years of surpluses as the prospect of a trade war with the US grows, Bloomberg reported. Alberta is poised be hit hardest by President Trump’s tariffs, as it supplies the bulk of the 4mb/d of crude oil that the US imports from Canada. In other news, China’s imports of Russian Far East crude and Iranian oil are expected to rebound in March as non-sanctioned tankers begin to replace vessels under US embargo, as per Reuters. A three-fold jump in freight rates for tankers to load ESPO crude from Russia’s port of Kozmino to China drew at least 17 non-sanctioned tankers on the route between 11 and 20 February, according to Vortexa. Meanwhile, British Energy Secretary Ed Miliband is set to visit China in March to restart talks on energy cooperation and meet Chinese investors, sources told Reuters. Finally, Argentina’s production output is anticipated to hit around 850kb/d at the end of 2025, according to S&P Global. The launch of additional capacity in March or April on a major oil pipeline is expected to accelerate production in Vaca Muerta by around 30%. At the time of writing, the Apr/May’25 and Apr/Oct’25 Brent futures spreads stand at $0.39/bbl and $2.62/bbl, respectively.