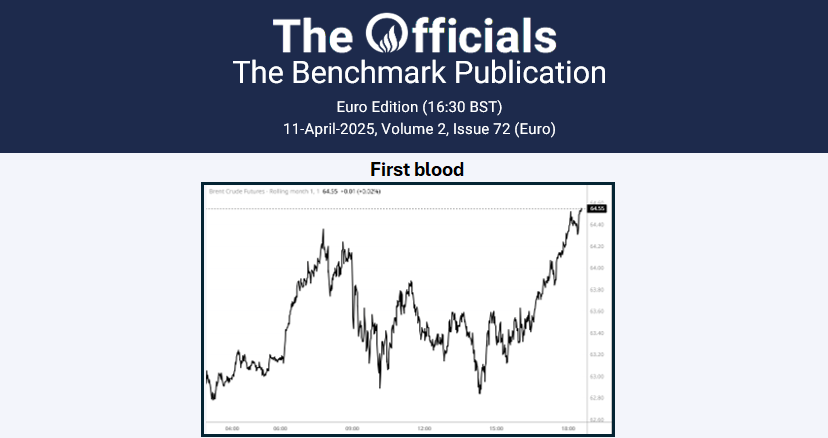

The Jun’25 Brent crude futures gapped down last night to $63.58/bbl. Prices dropped further to $62.54/bbl at 08:30 BST and then increased to above $63.60/bbl around 09:00 BST before falling again below the $63.00/bbl around 10:30 BST. There was some support around 11:10 BST (time of writing) and prices reached $63.60/bbl. China’s immediate reaction to tariffs imposed by the US has fueled fears of recession. Wall Street downgraded economic forecasts, and Saudi Arabia cut prices further, expecting weaker demand. OPEC+ added pressure by tripling its planned production increase, worsening the supply-demand imbalance, marking the second straight month of price reductions. In other news Libya is launching its first oil exploration bidding round in over 17 years, offering 22 areas with investor-friendly terms to boost output. The country, currently producing over 1.4 million bpd, aims to reach pre-war levels of 1.6mb/d. Despite ongoing instability and past disruptions, Libya hopes the new round will attract much-needed foreign investment. Finally, the front (Jun/Jul) and 6-month (Jun/Dec) Brent futures spreads are at $0.46/bbl and $1.37/bbl respectively.