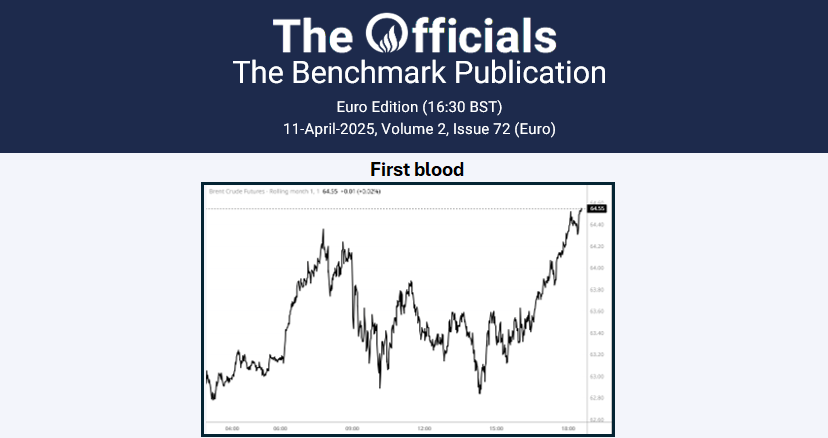

The sell-off in the Jun’25 Brent crude futures intensified on Friday morning, reaching another YTD low of $65.35/bbl at 11:40 BST (time of writing), having fallen by over $4 in the morning session. Goldman Sachs have lowered their Brent and WTI forecasts by $5 to $66/62, on tariff escalation and higher OPEC+ supply. China has announced an extra 34% tariffs on US goods from 10 April. Exxon expects up to a $2.7 billion profit boost in Q1, driven by stronger oil prices, refining margins, and trading gains. Forecasters expect an above-average 2025 Atlantic hurricane season, with 17 named storms and four major hurricanes fuelled by warm seas and favourable wind conditions. Elliott Management has launched a proxy battle against Phillips 66, pushing for board changes, asset sales, and governance reform to unlock value at the underperforming refiner. Meanwhile, BP Chairman Helge Lund plans to step down as the oil major faces mounting pressure from activist investor Elliott, following criticism of its strategic pivot back toward fossil fuels. Brookfield Infrastructure is acquiring Colonial Pipeline for about $9 billion, including debt, securing control of the largest U.S. fuel pipeline system in a major energy infrastructure deal. Finally, the front (Jun/Jul) and 6-month (Jun/Dec) Brent futures spreads are at $0.55/bbl and $1.92/bbl respectively.