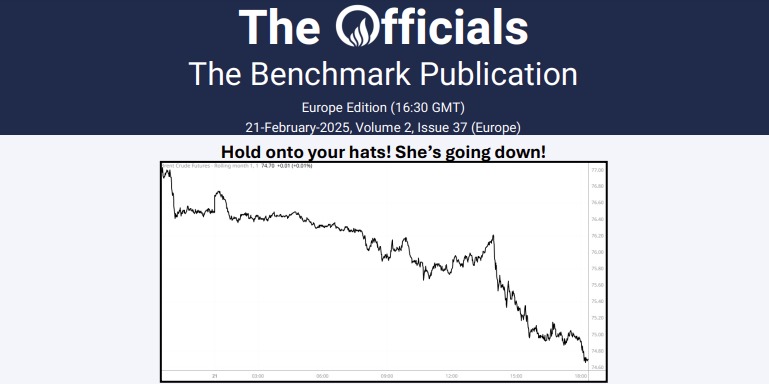

The Mar’25 Brent futures flat price had a volatile morning on Wednesday. It rose to highs of $80.46/bbl at 07:46 GMT before falling to lows of $79.63/bbl at 09:30 GMT and climbing again to $80.33/bbl by 10:18 GMT. Brent has been testing the $80/bbl level since Tuesday, and the intra-day low marks the lowest level reached this week. In the news, the U.S. sanctions on over 150 “shadow fleet” oil tankers have disrupted the seaborne oil trade, halting deliveries of 16 million barrels of crude and refined products from Russia, Iran, and Venezuela, while driving up tanker freight rates and creating uncertainty in global oil logistics. With China and India likely to pivot to alternative suppliers in response, the sanctions have tightened the tanker market, pushing VLCC rates up by 63% since early January. Trump’s proposed 25% tariffs on Canadian oil are pressuring Canadian crude prices and energy stocks, with analysts warning of further downside risks for producers reliant on US exports. Shell and CNOOC’s joint venture plans to invest $8.35 billion to expand its Guangdong petrochemical complex by 2028, adding a third ethylene cracker and facilities for specialty chemicals to serve China’s domestic market. California withdrew its EPA waiver request to mandate zero-emission trucks, anticipating rejection from the incoming Trump administration, a move that impacts other states adopting similar standards and reflects ongoing tensions over emissions regulations. Tengizchevroil has completed maintenance at Kazakhstan’s Tengiz field, with full production resuming by January 18. Finally, the front (Mar/Apr) and 6-month (Mar/Sep) Brent futures spreads are at $1.05/bbl and $4.46/bbl respectively.