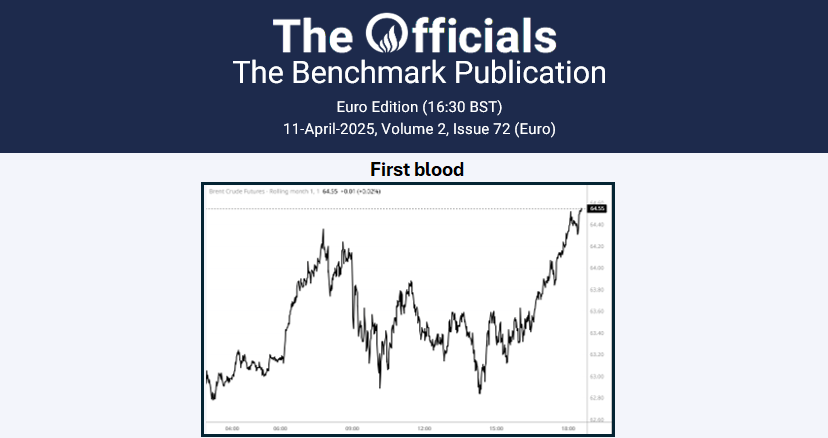

The Apr’25 Brent futures flat price came off below $76/bbl Wednesday morning, falling to lows of $75.40/bbl by 10:25 GMT (time of writing). Following the price spike after Trump reinstating his ‘maximum pressure’ campaign against Iran, market participants have been selling into the high and fading the rally. In the news, TotalEnergies raised its dividend and maintained $2 billion quarterly buybacks despite a 16% drop in Q4 earnings, attributing resilience to strong LNG and power business performance amid weaker oil prices and refining margins. Trans Mountain anticipates increased interest in its 890kb/d pipeline system if the U.S. imposes tariffs on Canadian oil, potentially boosting shipments to Asia as an alternative export route. Tanker stocks surged as Trump’s pledge to tighten restrictions on Iran’s oil trade raised concerns over reduced vessel supply, further boosting a market already impacted by Russian sanctions. Beneficiaries included US-listed Teekay Tankers Ltd, Scorpio Tankers Inc, Frontline Plc, and Tokyo-listed Mitsui OSK Lines Ltd. Equinor scaled back its renewable energy targets and investment just months after acquiring a $2.3 billion stake in Orsted, shifting focus back to oil and gas amid industry-wide pullbacks in offshore wind. Finally, the front (Apr/May) and 6-month (Apr/Oct) Brent futures spreads are at $0.57/bbl and $3.12/bbl respectively.