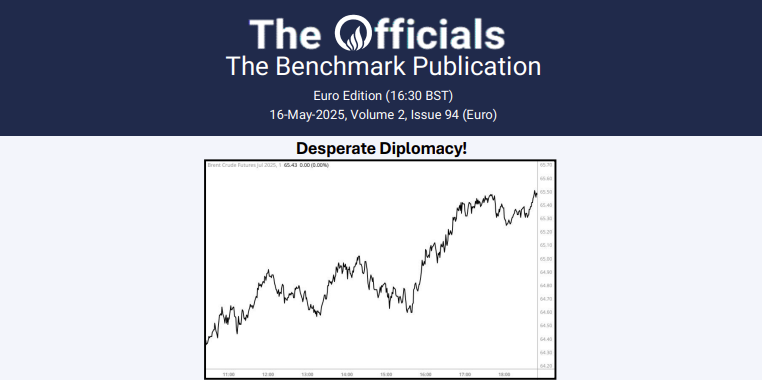

The Jul’25 Brent futures contract fell off this morning from $64.29/bbl at 09:31 BST to $ 63.64/bbl at 09:59 BST. Prices then rallied to $64.13/bbl at 10:37 BST before falling to $63.54/bbl at 12:30 BST (time of writing). In the news, power has been mostly restored in Spain and Portugal after a massive blackout on Monday, a spokesperson for Petronor said that their Bilbao refinery is gradually restarting. Spain lost 60% of its power due to a sudden grid failure linked to its connection with France. Authorities are investigating, with experts warning the high reliance on renewable energy may complicate grid stability. In other news, BP’s first-quarter profit fell 48% to $1.38B, below the expected $1.53B, due to weaker refining, gas trading, and lower production after asset sale. Strategy chief Giulia Chierchia will step down in June as CEO Murray Auchincloss faces pressure from activist investor Elliott to improve returns and cut costs. BP cut its capital spending plan to $14.5B for 2024 and slowed share buybacks to $750 million for the quarter. Several former Shell traders have launched Atmin, a Dubai-based oil trading firm focused on Africa, with financial backing from Afreximbank. Led by ex-Shell executive Ajay Oommen, Atmin aims to start with crude oil trading and expand into oil products and minerals. Afreximbank, which will hold a controlling stake, also announced a $3B financing program to support African and Caribbean fuel imports as major oil players retreat from the region. Finally, the front month Jun/Jul spread is at $0.94/bbl and the 6-month Jun/Dec Spread is at $1.74/bbl.