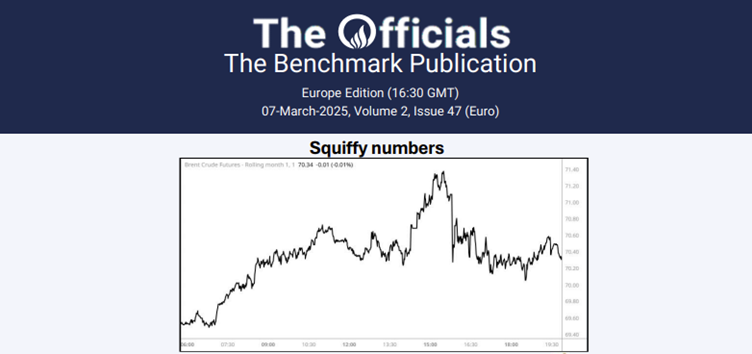

The May’25 Brent futures contract climbed from $69.55/bbl at 06:55 GMT to $70.65/bbl at 10:55 GMT (time of writing). These gains may have come from players unwinding short risk ahead of the weekend due to rising uncertainty in the market on a tariff and geopolitical risk front. Despite this, oil prices are still set for a weekly decline, down from an intraday high of $73.40/bbl on 3 Mar. The market will now be awaiting the release of US non-farm payrolls for February 2025 (consensus: 160k, prev: 143k). In other news, US President Donald Trump suspended the 25% tariffs he had imposed on most goods from Canada and Mexico, although the amended order does not cover non-USMCA-compliant Canadian energy products, on which a separate 10% duty was imposed. Tariffs on steel and aluminium imports to the US are expected to go into effect on 12 Mar, as scheduled. Finally, Ukraine’s energy minister has claimed that Russian forces targeted Naftogaz’s gas and energy infrastructure in various parts of the country in their latest drone attack. Finally, at the time of writing, the May/Jun’25 and May/Nov’25 Brent futures spreads stand at $0.52/bbl and $2.30/bbl.