HEAD OF RESEARCH REVIEW

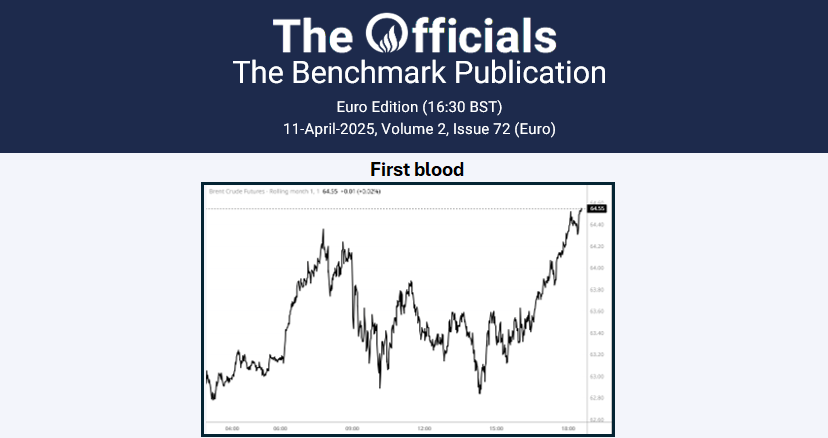

For all the uncertainty in oil markets these days, which typically brings out the bulls, the Brent flat price declined throughout February to end the month at just over $73 /bbl, or circa $3 down from where it traded by the end of January. What’s more, realised volatility in the front-month ICE Brent contract, measured on a rolling 30-day basis, has collapsed below 20%, which by oil standards is low. If US foreign and economic policy is leading by all accounts to a far less predictable environment for oil markets, the decline in the dispersion in daily price changes counterintuitively suggests a relatively sanguine disposition. If President Trump was widely viewed as a disruptive force across financial markets, oil prices have regularly come down since his inauguration day. Positioning in Brent by risk takers like money managers has seen net exposure on future contracts erode quickly in the past couple of weeks with the trimming of long gross positions. Has the market become complacent or simply resigned itself to a wait-and-see approach, letting events unfold rather than trying to preempt their direction? The annual International Energy Week (IE Week) industry conference saw the oil industry descend on London last month, and there was a plethora of opinions at the various conferences and hospitality events on what comes next and what course future events will take.