HEAD OF RESEARCH REVIEW

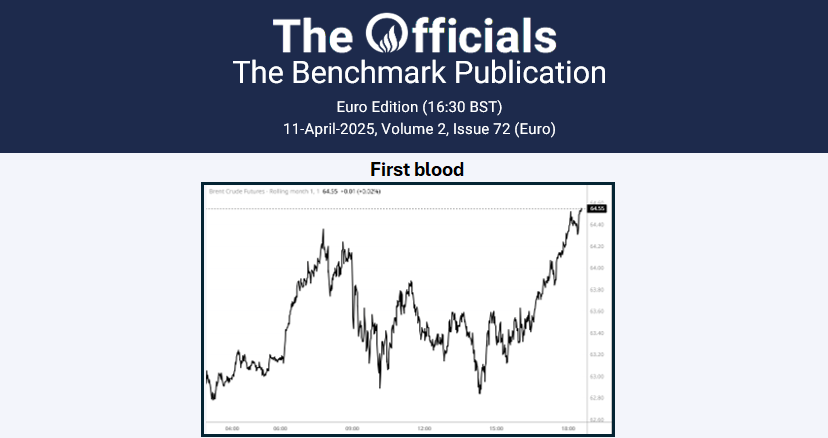

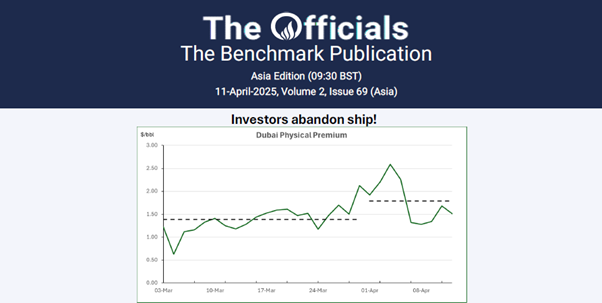

One thing is certain in global markets right now: uncertainty. Oil, like other risk assets, has had to navigate troubled waters in March and early April with the trading environment considerably obfuscated by the lack of clarity relative to the application of US tariffs, notably as we approached what President Trump called ‘Liberation Day’ on 2 April when reciprocal tariffs were announced to level the playing field with all US trading partners. ‘Discounted’ reciprocal tariff rates were established for several countries based on existing tariffs and non-tariff barriers, which varied in magnitude. Meanwhile, baseline tariffs of 10% were applied to countries that had little or no tariffs on US goods. The perceived negative impact on the economy of tariffs, even ahead of Liberation Day, only served to create a state of extreme risk aversion, with equities selling off and investors flocking to safe-haven assets like gold. Oil was not spared from the fallout, ultimately tumbling into the 60s in April as China quickly retaliated in kind and OPEC+ announced more supply, on paper. In the meantime, US economic exceptionalism is being questioned as the Conference Board’s consumer confidence index plunges to a 12-year low amid Fed policy rate inertia and growing perceived probability of a recession. In terms of geopolitical developments over the past month, tangible progress in achieving peace in Ukraine is absent, with agreements on energy infrastructure and maritime navigation in the Black Sea being the only notable advances. A US-Ukraine mineral deal now appears to be defunct, and if anything, President Trump appears to be getting frustrated, threatening ‘secondary’ style sanctions on Russia.