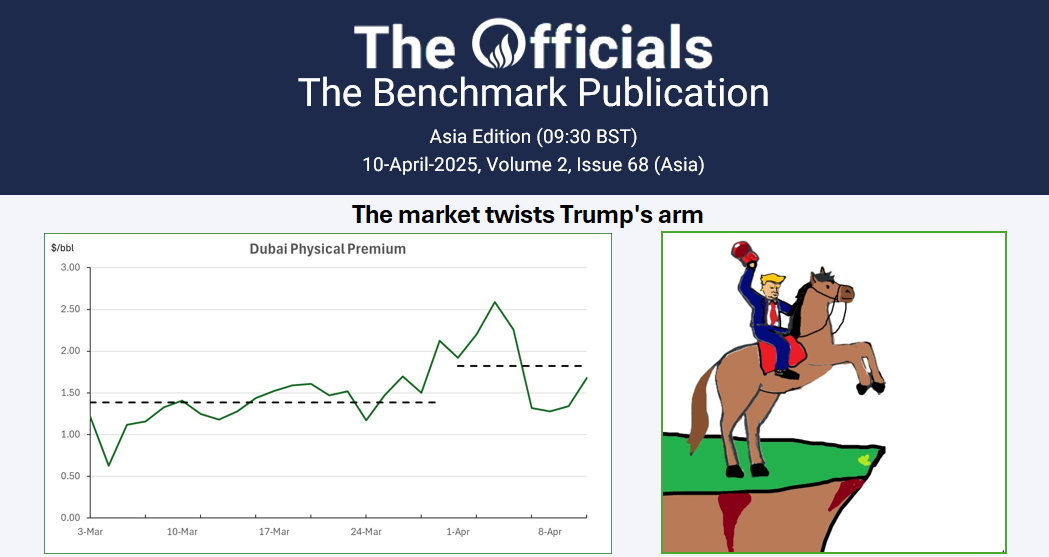

In the week ending 01 Apr, money managers further accelerated their purchases of crude futures benchmarks (Brent and WTI). This was mainly driven by movements in Brent futures. Crude prices saw strength at the beginning of the month, with front-month Brent rising above $75/bbl, the highest level since the end of February. Prices were supported by supply tightness fears on the back of intensifying sanctions on Iran and Venezuela. In addition, prices rebounded from a low baseline and broke through key technical resistance zones, while rising CTA net length fuelled the rally. However, the recent shift in market fundamentals may have spurred panic selling flows as fresh length sought to take profit.

Subscribe to Onyx Insights to unlock this research

Insights is the proprietary research arm of Onyx:

the #1 liquidity provider of oil swaps

OR