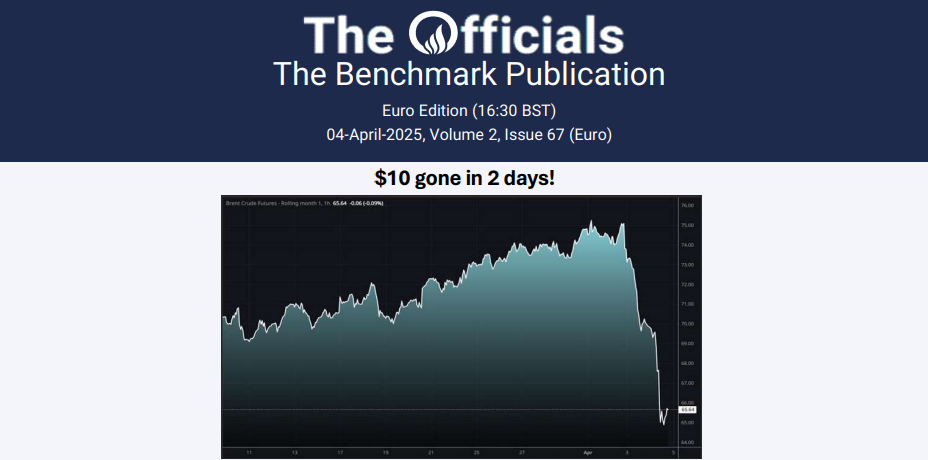

Jun’25 Brent futures rallied in the week ending 01 Apr, increasing from an intraday low of $72.15/bbl on 25 Mar to a weekly high of $75.25/bbl on 31 Mar, trading at mid-$74/bbl levels by 01 Apr. Crude oil prices saw support after Trump threatened to impose further sanctions on Russia and to bomb Iran. However, the Jun’25 contract has since reversed most of these gains on worries of US tariffs impacting oil demand, declining to $72.75/bbl on 03 Apr. In line with bullish sentiment in the week to 01 Apr, Onyx’s weekly CFTC COT predictor anticipates speculative players could add to their long positions in Brent and remove shorts. Managed-by-money long positions are expected to increase by almost 7.3mb, or +2.1% w/w, while their short positions could decrease by 2.1mb (around -2.5% w/w). Finally, prod/merc players are projected to add to both their long and short positions, by 10.3mb and 15mb, respectively.