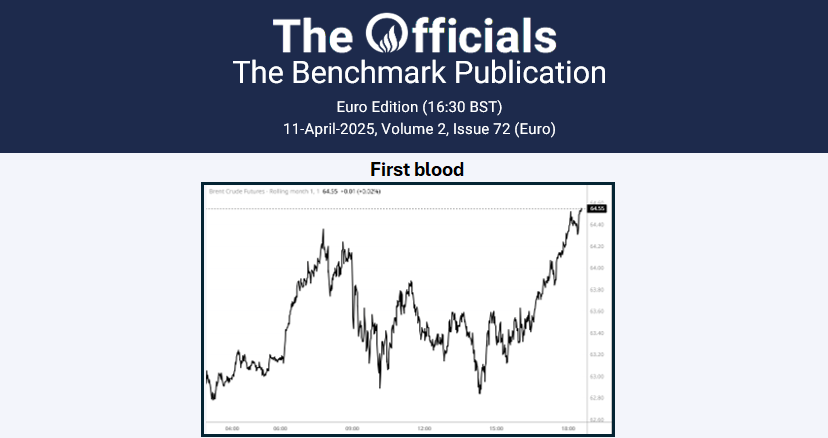

We ultimately saw weakness in the Apr’25 Brent futures contract for the week to 18 Feb, falling from an intraday high of $77.05/bbl on 11 Feb down to just above $74.00/bbl on 13 Feb, recovering to $75.85/bbl by 18 Feb. Crude oil prices saw bearish sentiment after EIA stats released on 12 Feb for the week ending 07 Feb showed a larger-than-expected 4.07mb build in US crude inventories, while developments toward Russia-Ukraine peace talks added further pressure. In line with this bearishness, Onyx’s weekly CFTC COT predictor anticipates speculative players could remove length risk in Brent, while building their short positions for the week ending 18 Feb. Managed-by-money long positions are expected to decrease by almost 5.7mb, or around -1.6% w/w. Meanwhile, speculators are projected to add just under 2.5mb to their short positions (+3% w/w). Finally, prod/merc players are expected to add around 31.4mb and 30.2mb to their long and short positions, respectively.