COT Reports

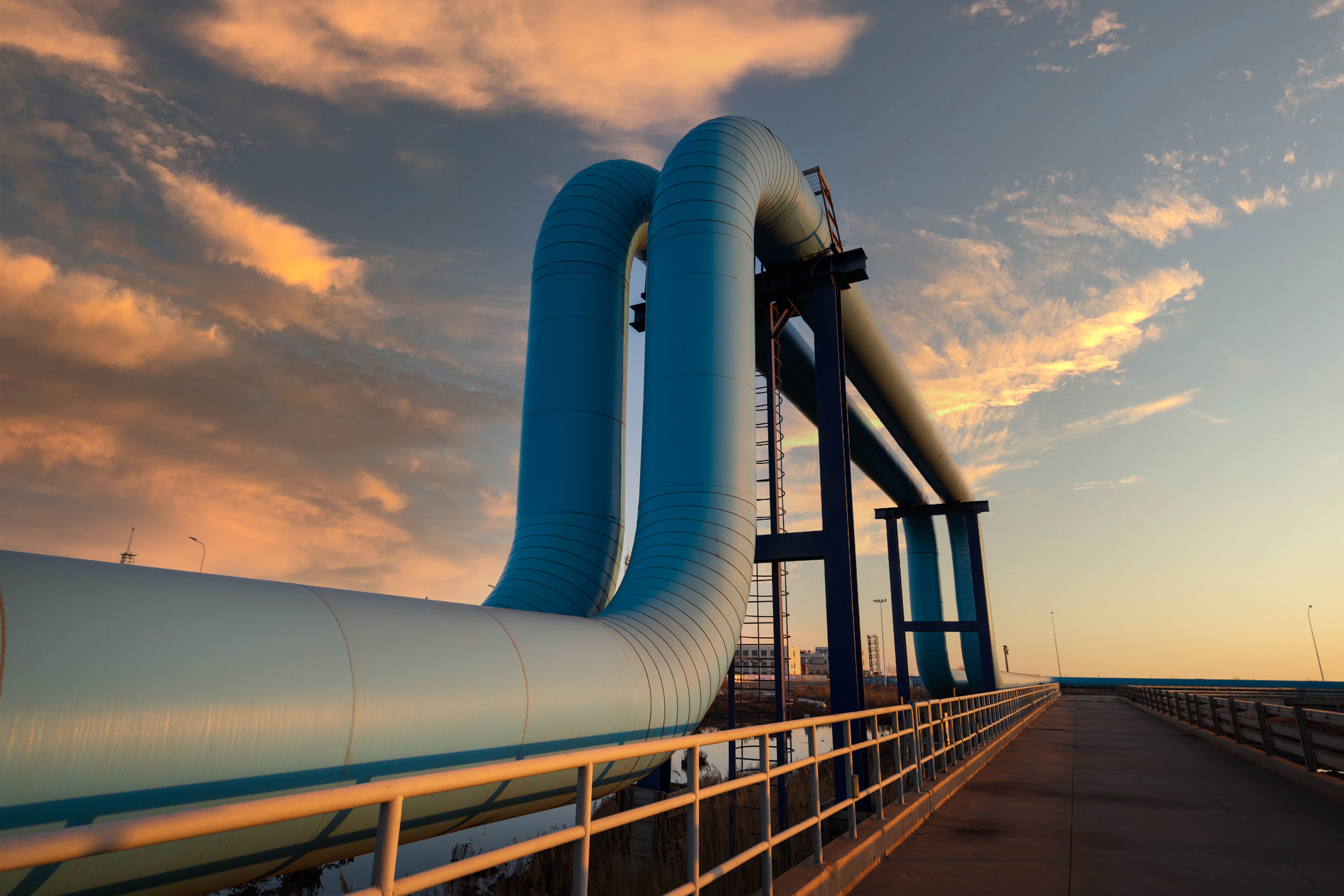

Gasoline complex ready for summer ?

European Gasoline saw strength in the past fortnight, with the Feb EBOB crack rallying to highs of $13.50/bbl, despite seeing sell side interest. The Sing 92 saw a rally as well, with both EBOB and the 92 contributing heavily to

Every-arb Everywhere All At Once

As the Red Sea conflict re-intensified over the weekend, geographical arbitrages went anywhere but sideways. See all the updates in this week’s Commitment of Traders report, as well as six one to watches for the week ahead.

What’s New in the New Year?

As the oil market settled into its first week of 2024, so did the derivative contracts. Trading volumes returned, whilst the geopolitical risk premium surrounding attacks in the Red Sea faded. See all the updates in this week’s Commitment of

First COT Report of 2024

With the TA arb dropping to lows despite bullish fundamentals the market seems to be to still be suffering from the holiday hangovers, with liquidity low in the VLSFO and the Naphtha EW, the market seemed to ease off its

Pirates of the Red Sea

Houthi militant attacks on commercial vessels voyaging the red sea was a hot topic in this week’s Commitment of Traders report, with freight rates rallying, gasoil E/W sinking and LST/FEI stagnating.

Moving in flow motion

Between the flows and fluctuations of the market, Onyx Research provides a unique report to unveil it all. The Commitment of Traders is a unique report leveraging Onyx proprietary data and methodologies to provide unique speculative market positioning data and flows.