European Window: Brent Drops to $61.35/bbl

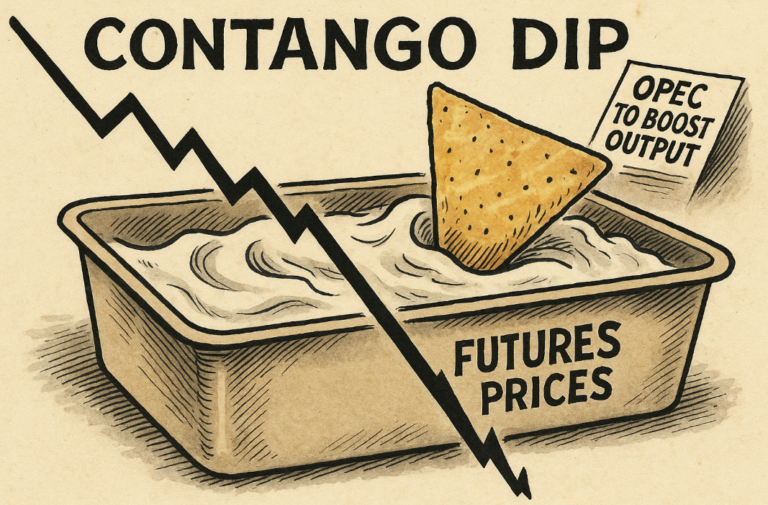

The Jul’25 Brent futures contract saw prices falling from $62.72/bbl at 12:56 BST down to $61.35/bbl at 17:30 BST (time of writing). In the news, US crude oil inventories fell by 2mb in the week ending May 2, according to the US Energy Information Administration (EIA), contrasting with the American Petroleum Institute’s report a day earlier of a 4.49mb build. Gasoline inventories rose by 200kb amid increased production, while distillate stocks declined by 1.1mb, with production also ticking up. Distillate inventories remain 13% below the five-year average. Overall, US petroleum demand rose, with total products supplied averaging 19.8mb/d over the past four weeks. In other news, Colombia’s state oil company Ecopetrol plans to reduce costs and expenses by approximately $232 million and indicated it may scale back its 2025 investment plan by around $500 million. Ecopetrol had reported a 22% drop in Q1 profits, citing global economic concerns and U.S. tariff threats. Despite the headwinds, its share price saw a slight uptick on Wednesday. Norway is set to expand its oil and gas production through a new licensing round in frontier areas. The government maintains that further exploration is necessary to sustain output amid declining reserves. Earlier this year, it awarded stakes in 53 new licenses despite environmental opposition. The industry plans to invest a record $24.7B in 2025, exceeding prior expectations due to both inflation and increased drilling activity. Finally, the front-month Jul/Aug and 6-month Jul/Jan’26 spreads are at $0.34/bbl and $0.52/bbl respectively.