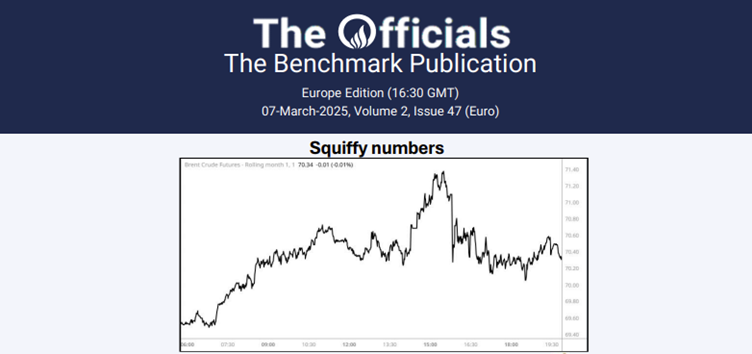

The May’25 Brent futures contract moved around $69.75/bbl overnight and softened slightly to $69.45/bbl at 10:47 GMT (time of writing). Asian stocks and currencies rose Thursday as China boosted fiscal stimulus and hopes grew for tariff rollbacks after the US granted a one-month exemption to some automakers. The MSCI EM currency index gained 0.5%, while Asian equities climbed 2.2%. Mysteel reported that Shandong-based refiners face declining operating rates (70% in 2021 to 43% in early 2025) due to rising feedstock costs, higher tariffs, and regulatory restrictions. As independent refiners weaken, state-owned refiners maintain stability with utilization rates above 75% in 2025. Harbour Energy reported a $93m loss, compared to a $45m profit last year, causing the North Sea-focused producer’s shares to drop over 11% in early trading. Oil demand in JODI-reporting countries fell in December by 706 kb/d m/m and 258 kb/d y/y. The monthly decline was mainly driven by lower demand in the US, Saudi Arabia, Germany, and India. At the time of writing, the May/June’25 and May/Nov’25 Brent futures spreads stand at $0.44/bbl and $1.99/bbl, respectively.