Brent saw a weekly loss amid thin trading on account of International Energy (IE) Week in London. May’25 Brent futures dropped from $74.05/bbl at the open of 24 Feb to around $73.30/bbl on 28 Feb’s close. This week, we expect a risk-off attitude to continue, with realised volatility below 20%. There is uncertainty in Trump’s policy and Europe continues to push support for Ukraine and attempt to mitigate the damage of Trump and his team’s public clash with Zelenskyy. This week, we anticipate Brent to finish the week between $70.00 and $73.00/bbl as the market evaluates the following factors:

- Developments towards peace in Ukraine

- Focusing on fundamentals

- Market positioning

Geopolitically, there has been an increase in uncertainty in the timeline for peace between Russia and Ukraine following a disastrous press conference on Friday. Europe is in a mediatory position to soothe egos, attempt to broker relations, and minimise the impact of the disastrous press conference. On Sunday, European leaders, led by the UK and France, continued to push for ramping up support for Ukraine and pushing for US involvement, aiming for a unified front against Russia. They agreed to sustain military aid, increase economic pressure, ensure Ukraine’s sovereignty in peace talks, and form a “coalition of the willing” to uphold any future peace deal – including boots on the ground following a ceasefire.

In the absence of agency reports (OPEC, EIA, IEA) this week, we expect the market to return its attention to the fundamentals. Last week, there was an unexpected 2.3mb draw in US crude oil inventories, following a few weeks of builds. Stocks in Cushing, OK, increased by 1.28mb, which is over 20% below last year’s levels. If commercial stocks return to weekly build, this may mitigate some upside. Continued stock builds in Cushing may also limit the upside in structure. This week, the report will be for the week to 28 Feb, which saw more stable, warm weather across the country.

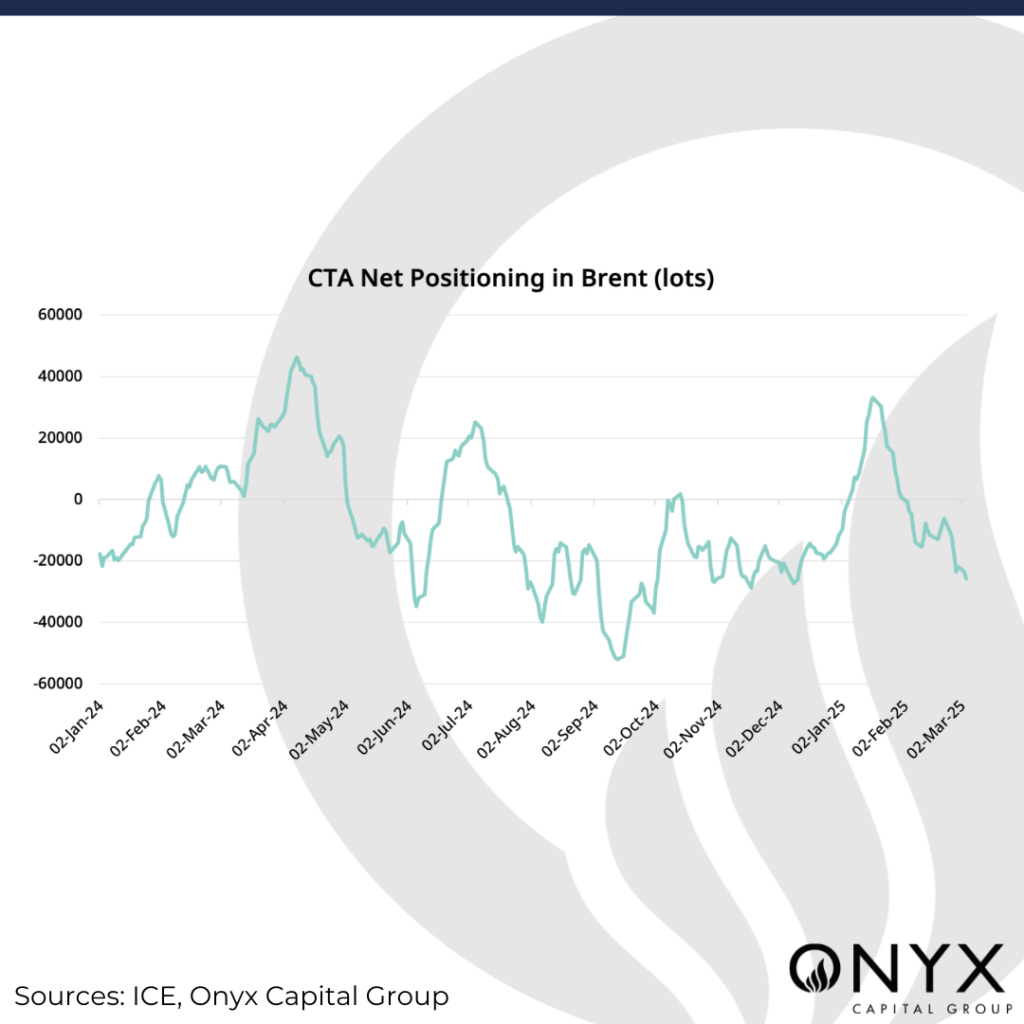

Lastly, ICE COT data for the week to 25 Feb showed speculative players parring length with a removal of 40.9mb of length (an 11.57% w/w drop). This brought managed by money outright length, and net positioning to their lowest level in 2025. This same exodus of long risk was seen in WTI futures, as the combined positions in WTI and Brent showed managed by money players removing 52.2mb (9.80% w/w drop) in the week to 25 Feb. There seems a lack of confidence in pre-empting policy and a movement to more neutral exposure in the wake of this. Onyx’s in-house CTA model shows net positioning dropped in the week from -10k lots to around -20k lots – which shows selling flow but there remains a lot of room in either direction to deploy risk – as this is far from an extreme level.