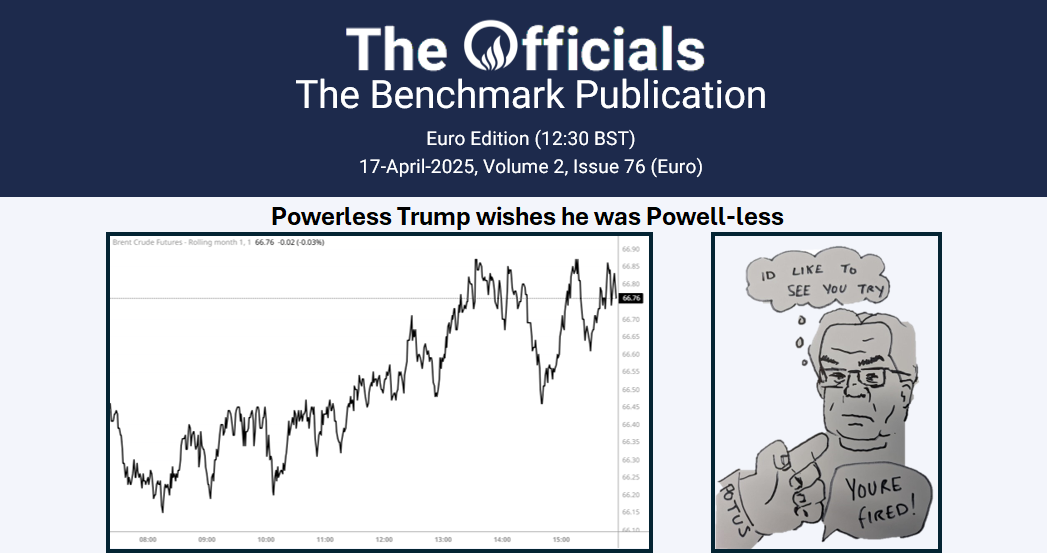

The Apr’25 Brent futures contract has seen weakness today, trading from an overnight high of $75.25/bbl at 04:45 GMT down to $74.65/bbl at 10:05 GMT, recovering to $74.75/bbl by 10:45 GMT (time of writing). In the news today, the UN has adopted a US-drafted resolution which takes a neutral position on the Russia-Ukraine, reiterating the UN’s purpose to maintain international peace and urging a swift end to the conflict, as per Reuters. Russia’s UN Ambassador Vassily Nebenzia acknowledged “constructive changes” in the resolution as a “starting point for future efforts”, but also that it was “not an ideal one”. This came after the US failed to convince the General Assembly to pass the same resolution earlier on Monday. Meanwhile, the US Office of Foreign Assets Control has added four Indian companies to its latest list of entities sanctioned for involvement in Iranian crude oil, alleged to be part of Iran’s shadow fleet. In other news, BP is expected to announce a plan on Wednesday to stop pursuing reductions in crude oil and natural gas production, according to Financial Times. BP previously aimed to cut oil and gas production by 40% by 2030 but is set to U-turn in a bid to please its new major shareholder Elliott Management. Finally, President Trump wants the Keystone XL pipeline built, stated in a post on Truth Social. Trump wrote “the company building the Keystone XL Pipeline that was viciously jettisoned by the incompetent Biden administration should…get it built now!”. At the time of writing, the Apr/May’25 and Apr/Oct’25 Brent futures spreads currently stand at $0.48/bbl and $2.54/bbl.