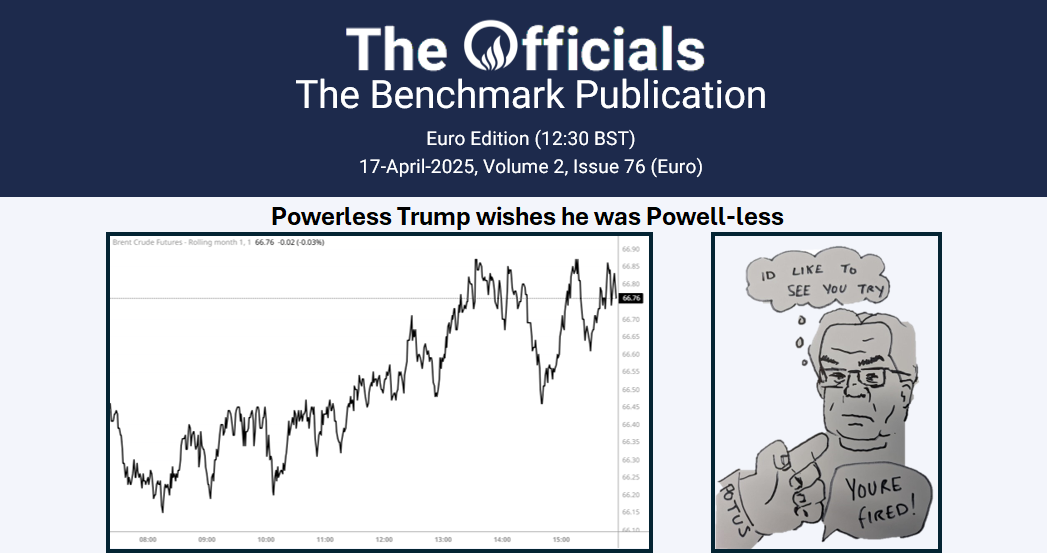

The Apr’25 Brent futures saw prices rise to $76.28/bbl at 0800 GMT before dropping to $75.81/bb at 0854 only to jump back to $76.00/bbl at 0900 GMT and has slowly been climbing up to $76.26/bbl at 1043 GMT (time of writing). Turkey’s top oil refiner, TUPRAS, has halted Russian crude imports to avoid US sanctions, reflecting the challenges of balancing supply and Western market access. Meanwhile, Russia reported a 30%-40% drop in Caspian Pipeline flows after a Ukrainian drone attack, cutting up to 380 kb/d. Norway’s January oil production hit 1.775 mb/d, slightly above expectations despite a year-on-year decline, while cold weather reduced North Dakota’s output by up to 130 kb/d. Additionally, Iranian crude exports to China rebounded 86% in February despite US sanctions. The Biden administration’s last-minute sanctions targeted tankers and trading entities, but new receiving terminals and ship-to-ship transfers have facilitated the flow, though a renewed US “maximum pressure” strategy may curb exports again.The front (Apr/May) and 6-month (Apr/Oct) Brent futures spreads are at $0.33/bbl and $2.48/bbl, respectively, at the time of writing.