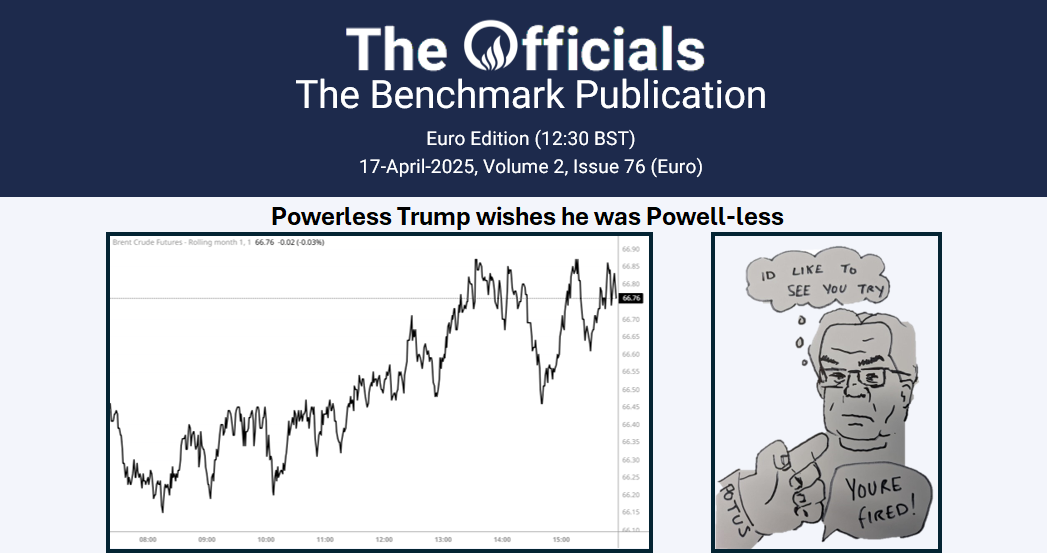

The Apr’25 Brent futures flat price saw a quiet morning, slowly rising from $76.16/bbl at 0700 GMT to $76.42/bbl at 1030 GMT (time of writing). The rise came as president Donald Trump signalled a possible tightening of restrictions on Chevron’s oil exports from Venezuela, amid ongoing tensions with the Maduro government, while uncertainty surrounding Ukraine peace talks also provided support to flat price. Goldman Sachs predicts that a potential Ukraine ceasefire and eased sanctions on Russia will not significantly increase Russian oil flows, as production is constrained by OPEC+ targets rather than sanctions. In other news, Glencore increased its oil and gas trading volume in 2024 to 3.7mb/d, up from 3.3mb/d in 2023, but its earnings from energy trading dropped 47% to $908 million, reflecting a return to normal levels after prior market volatility. Despite expanding its oil portfolio, Glencore remains below its 2019 trading peak, while competitors like Trafigura saw higher traded volumes. The front (Apr/May) and 6-month (Apr/Oct) Brent futures spreads are at $0.45/bbl and $2.75/bbl respectively at the time of writing.