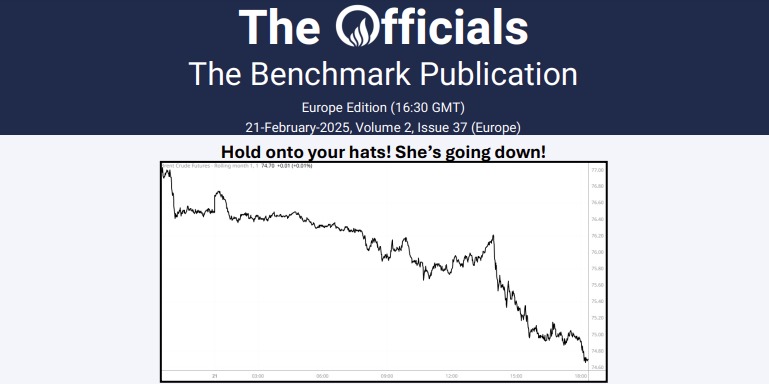

The Apr’25 Brent futures contract was supported above the $75/bbl handle this morning, climbing to $75.85/bbl at 09:40 GMT, where it initially met resistance, before ultimately climbing to $75.95/bbl at 10:40 GMT (time of writing). It will be interesting to monitor whether the contract closes above the 10-day moving average of $75.25/bbl, a significant resistance level for the contract towards the end of January and into February. A senior Russian official reported on Monday that Ukrainian drones had attacked the Kropotkinskaya station, a CPC pumping station in the southern Krasnodar region in Russia, impacting Kazakhstan’s oil exports. In other news, Indonesia is studying the potential implementation of a biodiesel blend that contains 50% palm oil in 2026 and is seeking a 3% blend for jet fuel next year. In macroeconomic news, a survey by the German Association for Cities showed that 37% of major German cities could not balance their budgets and 47% relied on reserves, with only 2% of all German cities optimistic about their finances for the next half-decade. Finally, at the time of writing, the Apr/May’25 and Apr/Oct’25 Brent futures spreads stand at $0.40/bbl and $2.58/bbl, respectively.