Sell Baby Sell?

On Monday, we forecast the front-month Brent futures contract to hover between $74 and $77/bbl by the end of this week. As of Friday, at 10:05 GMT, the M1 futures contract is trading at $75.40/bbl. In line with our forecast, M1 Brent tested the $77/bbl handle mid-week, where it met substantial sell-side pressure and briefly fell below $75/bbl on Thursday.

Retrospectively, we identify three factors that were significant for price action this week:

- Uncertainty regarding a peace deal between Russia and Ukraine

- Continued tariff talks

- US inflation coming in higher in January

In a lengthy call on Wednesday with Russian President Vladimir Putin, US President Donald Trump discussed a possible start to negotiating an end to the war in Ukraine. The news took the M1 Brent down from nearly $77/bbl to under $75.10/bbl, recording a significant bearish Marubozu candlestick. The end of the war would cease the attacks on Russian and Ukrainian energy infrastructure and would likely involve the Western world lifting its sanctions on Russian oil and gas. However, uncertainty regarding the timeline of the peace deal, alongside rising friction between the US and Europe on the terms of the agreement, could delay the deflation of risk premia in oil prices that a resolution to the war in Ukraine would bring. It will be key to watch for Moscow’s response to US Vice President JD Vance’s threat to impose sanctions and potential military action on Russia if President Putin disagrees with a peace deal with Ukraine that guarantees Kyiv’s long-term independence.

In addition, President Trump signed a memorandum instructing officials to develop custom tariffs for countries matching what they charge the US, including counteracting barriers such as value-added taxes and vehicle safety rules that exclude US autos. President Trump’s pick for Commerce Secretary, Howard Lutnick, said his team will be ready to hand in a plan by 1 April. Such tariffs may distort global trade flow, injecting concerns of higher inflation.

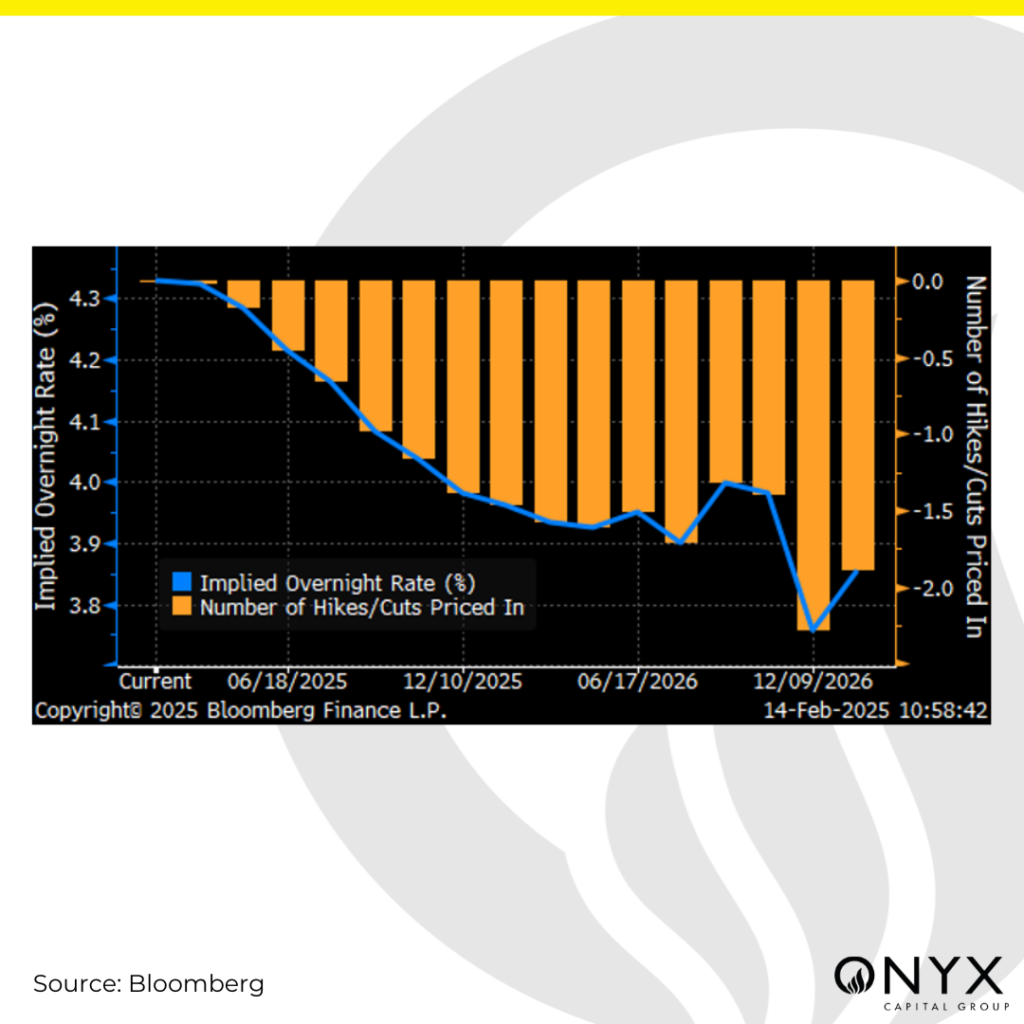

These fears of higher inflation emerge alongside the Jan CPI, revealing a higher-than-expected 3% rise in inflation y/y. The Jan PPI stood at a higher 3.5% y/y relative to a forecast of 3.2%. Unsurprisingly, Fed Chair Jerome Powel, testifying in front of the Senate and the House Financial committee this week, indicated that there was no rush to lower policy rates. This acceleration in inflation has led to the market pushing back its hopes for a rate cut by the US Federal Reserve, with the US OIS now pricing in a full cut in Q4 2025. Higher-for-longer interest rates may continue to support the US dollar while dampening consumption in the US, which could dampen oil demand.