March Brent began the week with a strong correction, down around 2% to close at $76.93/bbl on Monday. The move came with a significant weakening of price structure, as the prompt month-time spread shed some 20 cents to $0.80/bbl. Oil prices were correcting last week following Donald Trump’s inauguration as the 47th president of the United States, and the move has accelerated today, potentially with an increase in risk aversion. We cannot discount further weakness in oil prices this week, predicated on the factors below, and expect Brent to end the week in a range between $75-79/bbl.

- Trump’s carrot-and-stick approach to tariffs

- Co-movement in risky assets, with turbulence in equity markets spilling over to oil

- CTA paring longs ahead of China’s Lunar New Year festivities

US tariffs and their uncertain implementation loomed large over the market last week. For President Trump, tariffs are a means to achieve economic and domestic goals. For the latter, threats levied against Colombia when the country refused to accept deported illegal immigrants are a case in point. Regarding economic goals, the imposition of tariffs on Canada and Mexico on 01 Feb is still indeterminate – the threat of tariffs may be a means to renegotiate the USMCA trade accord. If Trump gets his way, then Canadian and Mexican oil supply will continue unhindered by price considerations. Then there is Russia and China, for which Trump appears to be adopting the carrot rather than the stick approach. In the midst of all of this, Trump has also called on OPEC to reduce the cost of oil. Depending on the outcome and timing of the above, the result is heightened uncertainty, which lends itself to lower risk appetite. The tariff uncertainty can cut both ways: oil prices can rally if they are positively resolved. If they drag on, oil prices may well move lower.

US equity markets are another source of concern from a risk appetite point of view. This week, the Fed will gather for its January FOMC with consensus looking for policy rates to remain on hold. This will not play well with Mr Trump, who has been calling for lower rates. Even if the consensus expects the Fed Funds rate to remain at 4.5%, there could nonetheless be an adverse reaction to the announcement. At the same time, the US tech sector driving index performance is contending with developments in China where multiple AI models, reportedly 50 times more efficient than their US counterparts, have been deployed. If tech wobbles, equity indices can correct and oil might dovetail the move. The concerns arising from the above could help explain a rally in safe-haven currencies or bond markets rallying with noticeably lower yields on US 10-year treasuries.

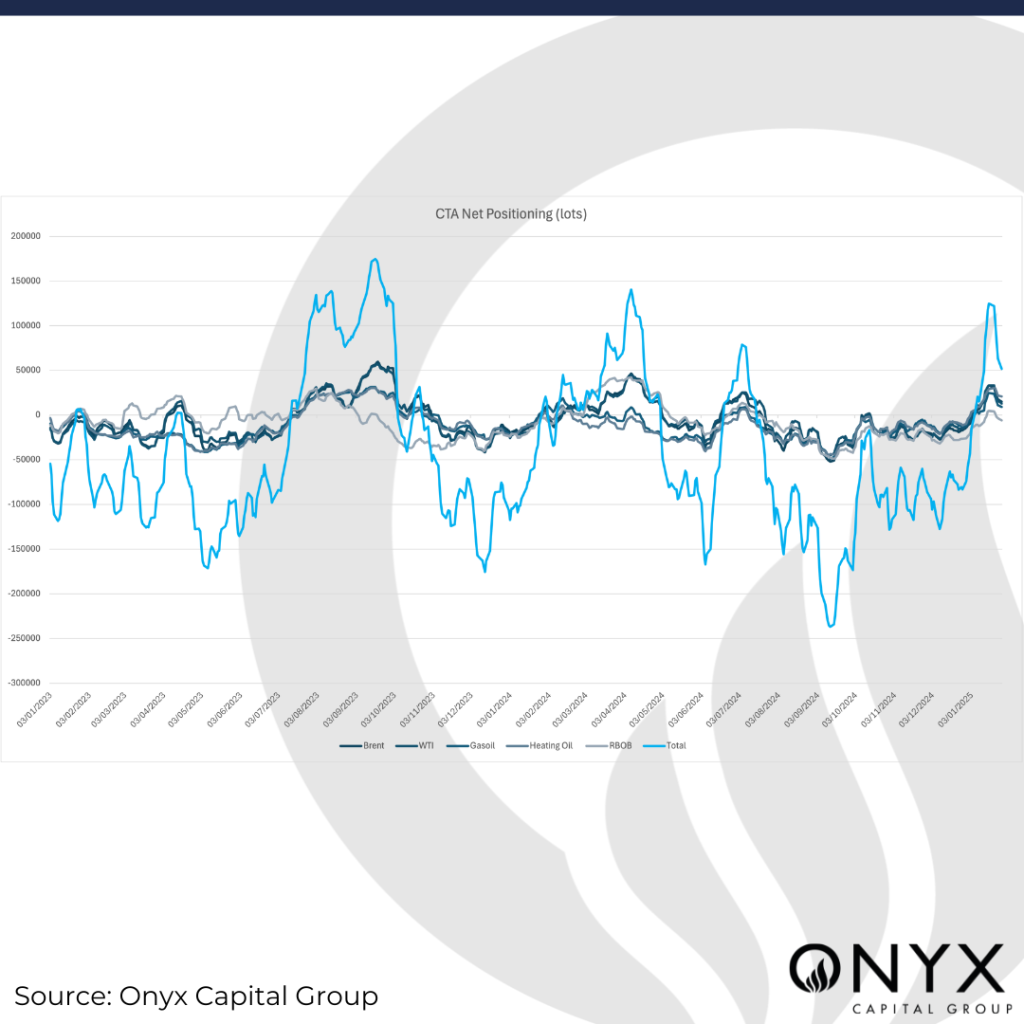

The official commitment of traders data released by ICE for the week ending 21 January showed that managed money raised their net position by 5.5mb (1.5% w/w). However, the data was before Mr Trump really got going in his first week. In contrast, Onyx’s proprietary CTA modelling shows that the positioning of these market participants has come down from highs of 125k lots on 17 Jan to below 65k lots on 24 Jan. This could foreshow a similar move by money managers this week, particularly as liquidity will be reduced during the Chinese New Year festivities.