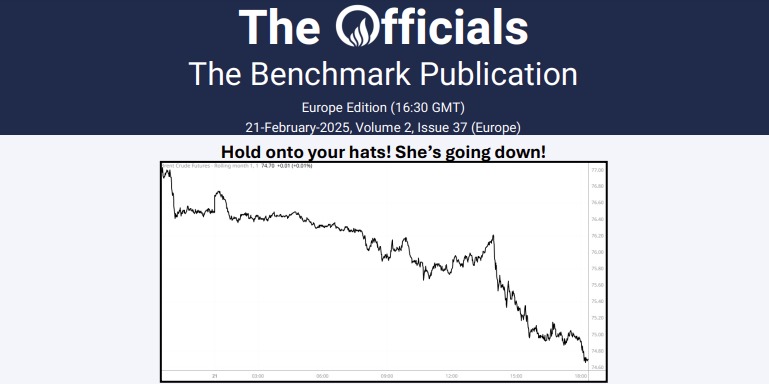

The Mar’25 Brent futures contract gapped down this morning, where it met support above $77.50/bbl between 0100 and 0220 GMT before seeing greater support into the morning. The prompt has now inched up to just shy of $78.85/bbl at 1042 GMT (time of writing), as it fails to surpass Friday’s strongest intraday level. President Trump’s brief proposal of a 25% tariff on Colombian goods, following Colombia’s refusal to accept deported migrants, raised concerns, and this escalation temporarily increased demand for safe-haven assets, including the dollar. However, the situation de-escalated as the White House halted the measures after the South American country agreed to Trump’s conditions. Following the open letter from the API last week, Mark Scholz, the president and CEO of the Canadian Association of Energy Contractors (CAOEC), has also come out against the inclusion of oil and gas tariffs. “Both of our economies, particularly when it comes to energy, are highly integrated and highly efficient”. The Sudanese army has secured the 100kb/d al-Jaili oil refinery’s perimeter after regaining control from the RSF, though fires—spreading from storage tanks to production units due to insufficient firefighting resources—have continued burning for five days, marking the facility’s most severe blaze since the conflict began. At the time of writing, the Mar/Apr’25 and Mar/Sep’25 Brent futures spreads stand at $1.03/bbl and $4.33/bbl, respectively.